DENTAL AND VISION INSURANCE

After health insurance, people are most interested in adding dental and vision coverage for themselves or their families. Without insurance, dental and vision costs can add up to a significant cost each year.

For vision or dental insurance in Missouri, Illinois or another state, please contact MBhealth for a free consultation. We represent you, not the insurance companies. We are interested in learning your needs and desires so we can find the best coverage for you.

Call us at (314) 544-5400 for a free consultation or fill out the form below and we will be in touch within two business days.

DENTAL AND VISION INSURANCE Frequently Asked Questions

When you’re looking for dental insurance, it’s important to review your coverages carefully before purchasing. Some types of dental care—usually preventative care—are covered 100%. Most other types of dental care are only partly covered. Plus there can be long waiting periods for major services. You may also be required to visit a dentist from the plan’s list of providers which may or may not work out for you. All these points must be reviewed before making a choice.

Many dental plans cover as much as 80% of simple dental services like fillings, but a deductible will usually apply. If you want to visit a dentist who is not on your plan’s network, then you will have to pay more of the cost.

If you need major work such as a crown or dentures, you can expect the plan to cover as much as 50% of the cost. Again, you will have a waiting period so you need to look ahead toward future dental work that you or your family could need and a deductible will usually apply. Dental implants are not generally covered.

There are many other factors involved in your costs, such as annual maximums, copays and coinsurance. Discussing your dental insurance needs with an experienced insurance consultant can help you get the best coverage for yourself and your family. MBhealth can help you make the right choice.

The right dental insurance for you depends on your own needs and those of your family. The costs of the policy itself must be compared to the amount you expect to save on your family’s dental expenses in the following year. You should also consider that you will need to wait three, six or twelve months before you have coverage for any major dental work.

For a single person who does not have any dental issues, a preventative care-only plan may be a good option. These plans are relatively inexpensive and may cover routine preventative care at 100%.

A dental insurance policy can be valuable in helping a family budget their dental expenses for a year by distributing their expected expenses across twelve monthly and predictable premiums.

In some situations, however, it is worth the cost to enroll in a plan that provides not only preventative dental care but also basic and major care. For a family with multiple children needing dental care, it’s possible that major or extensive care will be needed. This type of plan will cost more in premiums but the savings can make it worth the investment.

Need help finding the right dental plan for your family? Contact MBhealth for help.

Yes, most plans have a waiting period before you can receive certain kinds of dental care. For preventative care, most plans do not require a waiting period because receiving regular preventative care is likely to save both the insurance company and the insured person money. So in most cases, you can schedule cleanings, x-ray, exams and fluoride treatments right away.

Those services termed “basic” very often have a waiting period of three to six months. Included in this category are fillings and simple (non-surgical) extractions.

For major dental work, you may have to wait an entire year. These services include crowns, bridges and dentures.

Oral surgery to extract an impacted wisdom tooth is considered a major service. To cover this expense, you must make sure that your dental insurance covers major services when you enroll in the policy. The same is true for root canal treatments.

Cosmetic procedures such as whitening are not generally included in any dental insurance plan.

It is important to know the exact coverages of your dental insurance plan before your enrollment to prevent surprise costs. MBhealth can help you find the best dental plan for yourself or your family. Call us today.

Fee Schedule Dental Insurance is a way of obtaining reduced-price coverage for a wide array of dental treatments. A fixed benefit amount is set for all the most common dental procedures. There are more than 400 different dental services available on lists published by insurers. This set schedule is published, noting the fee paid by the patient for each dental treatment so that the insured person can immediately see what their costs will be. The amounts on the fee schedule are far less than the usual charges for dental work.

For some individuals and families, this type of insurance coverage offers lower-cost benefits than standalone dental insurance. The established fee varies by the level of coverage chosen. These plans are often part of group health benefits from an employer. Orthodontic and vision care are available as add-ons.

Waiting periods of three, six and twelve months may apply to different services. For example, for a filling, there is a three-month wait. For bone surgery, there is a six-month wait. Crowns and onlays require a twelve-month wait. There is no wait for cleanings and this preventative care is covered fully.

If you would like more information on Fee Schedule Dental Insurance, please contact MBhealth.

A PPO is a preferred provider organization. A DHMO is a dental health maintenance organization.

With a PPO you can get coverage for dental services from a specific list of dental providers that are contracted with the insurance company. You will pay the least possible out of pocket if you get treatment from these dentists. If you want to receive dental care other than preventative care, there is normally a waiting period. There is a limit to the maximum amount of annual benefits.

With a dental HMO, you will also need to choose a dentist from a specific list, and you may also need to choose a primary care provider from the same network. You will usually have a copay for your dental care. However, dental HMOs do not generally impose a maximum on your benefits each year.

With a PPO, you can usually see a dentist outside the approved network, though you will pay more. With an HMO, services from dentists outside the network are typically not covered at all.

Before you make your choice of a PPO or DHMO, look at the provider list carefully. Ensure that any dentists that are important to you and your family are included on this list. You may also need to re-check this list annually to ensure you are not going to lose your favorite provider.

Vision insurance can vary widely so it is important to carefully review the coverage provided in your employer’s plan or your individual policy. Vision insurance generally covers an annual examination and an allowance toward glasses and contacts. You may need to see an eye doctor included in the plan’s network, though not all plans have this requirement.

If you choose to receive laser eye-correction surgery such as LASIK, there may be a discount for this care.

Just like any other kind of health insurance, you will probably have a deductible, copay and coinsurance costs due as you receive treatment.

If you regularly incur vision costs, then vision insurance can be worth the costs. Whatever choice you make, it’s smart to have your eyes checked annually so that early treatment can start for any problems that are identified.

Before making your choice, calculate your annual costs and then compare that with the premiums and out-of-pocket costs with specific vision plans. If your family has any history of eye problems, then vision insurance might be a high priority for you.

MBhealth can help you take all these factors into account so you make the right choice regarding vision insurance.

If you incur vision costs regularly, you should start by calculating your annual cost for care, including any premiums for insurance you might currently have plus copays, co-insurance and deductibles. If you don’t yet have insurance, compare your current total annual costs to the amount you would pay after you have insurance in place. If you already have insurance, total your current out-of-pocket costs and then recalculate those costs based on other insurance choices you have.

Vision insurance usually costs around $5 to $30 per person, monthly. However, the more benefits that are offered, the higher the premiums will be. If you find vision insurance too expensive for you, check into vision discount plans that may be available in your area.

Most plans offer preventative care in the form of annual eye exams. It is important to take advantage of this benefit as there are several eye diseases that respond to early treatment but not so well to late treatment.

Most vision insurance plans do not cover major medical treatments or surgery but these might be covered by health insurance. If you need help making sure you find the best vision insurance for yourself or your family, please call MBhealth.

Typically, vision insurance covers preventative care in the form of one eye exam per year, plus there is usually an allowance for prescription glasses. Fittings for contact lenses and the lenses themselves are also usually included in coverage.

Sunglasses are often partially covered if they have prescription lenses. Non-prescription sunglasses are sometimes available at a discount if they are purchased from a provider that is in-network with the insurer.

Some plans will require you to see their preferred providers.

Vision correction insurance such as LASIK may be available at a discount.

There are some eye care costs that might be covered by health insurance, so don’t forget to check that coverage if you anticipate needing major medical treatment or surgery.

Some insurers offer discount plans that provide a set discount on any qualified services, such as 20%. This type of plan will usually be less expensive.

Be sure to check on waiting periods before committing to vision insurance. If you need benefits now and the waiting period for a plan is 36 months, you might want to look at other plans. Call MBhealth if you need guidance to choose the best vision insurance for your situation.

If you feel you need eye care soon, be sure to check on the waiting period for any vision insurance you’re considering. Some vision insurance providers have waiting periods and others do not. A typical waiting period might be 30 days.

However, if you are looking for vision insurance as part of a group health plan offered by a new employer, there may be a 90-day waiting period on your being eligible for the full benefits of that plan.

If you foresee any eye care being needed in your future, or if your family has a history of eye diseases, the best thing you can do is obtain vision insurance long before you need it. Then you don’t have to worry about a waiting period associated with a policy that is otherwise right for you. MBhealth can help you review the vision insurance plans available to you and compare the costs to your expected eye care costs. MBhealth works for you, not the insurance companies.

Regular medical health insurance will provide coverage only for treatment of eye injury or eye diseases. Eye conditions considered “medical” and not “vision care” include vision loss, infections, diabetic injury to eyes, floaters or dry eyes. These conditions can be treated under most people’s medical insurance.

Benefits for eye exams, glasses or contact lenses are normally not included in health insurance as these are considered vision care benefits, not medical benefits. For vision care benefits, vision insurance can be added to the medical coverage you obtain through the Affordable Care Act/Marketplace by a separate policy.

The original Medicare plan also does not include vision care benefits. Medicare Part B will usually cover most of the cost of treatment for eye diseases or cataract surgery (if you have met your deductible). Here too, you can obtain supplemental vision care insurance to cover eye exams and glasses or contacts.

Medicare Advantage (Medicare Part C) plans often do include basic vision care coverage. Marketplace health insurance also covers cataract surgery in part, if it is considered medically necessary.

There are many standalone vision insurance plans available for a person covered by Medicare or Affordable Care Act insurance plans. If you need vision insurance, call MBhealth and ask about a supplemental plan that can provide combined vision and dental coverage.

Book a Free Consultation

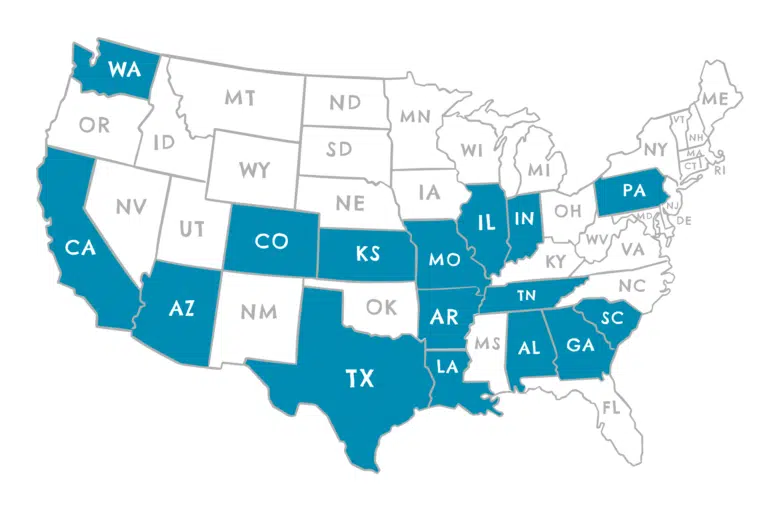

STATE LICENSURE

- Alabama

- California

- Colorado

- Georgia

- Illinois

- South Carolina

- Indiana

- Kansas

- Arizona

- Louisiana

- Missouri

- Arkansas

- Tennessee

- Pennsylvania

- Texas

- Washington