EMPLOYERS SMALL GROUP HEALTH INSURANCE

If you’re an employer consisting of 2-50 employees, you are considered a small business. Quotes for a small business group health insurance plan are available in a lot of different ways, but there’s no way to know if it’s right for your business. It takes experience to factor in all the variables when planning a small business group health insurance plan. Because we have that experience, we help you maneuver all the things you want to know about when implementing a group health insurance.

In a consultation with one of our representatives, you’ll soon learn the answers to these questions and more:

- Is it the right time to provide benefits for my employees?

- How do I get started?

- How much will it cost the company to do so?

- Which plan is the best?

- Can this expenditure help me become more profitable?

After we come to decision together, we’ll guide you through the steps involved in implementing this plan. As our relationship continues, and your business is changing and growing so will your needs as a company and those of your employees and we are here to help keep you abreast of needed changes.

Giving you the right advice at this time requires understanding group plans as well as coverage under the Affordable Care Act and the many situations that affect your health insurance in a business environment.

Why Small Group Health Insurance Matters

Offering small group health insurance is more than simply getting coverage for your employees. It’s a strategic move that can significantly impact your company’s success. In today’s competitive job market, employees are looking for more than just a paycheck—they want benefits that provide security and peace of mind. They want someone that can walk beside them as they experience health issues along the way. By survey, health insurance is the most desired benefit an employer can offer.

Providing group health insurance can help you attract top talent and retain your existing workforce. Employees who feel valued and supported are more likely to stay with your company, reducing turnover. Moreover, offering health benefits can lead to increased productivity, as employees are more likely to seek preventive care and address health issues before they become serious. The more competitive your business environment, the more you need to offer this benefit to your employees.

Small businesses seldom have enough HR staff to assign a dedicated person to administer the health insurance benefit. MBhealth works with owners and their administrative staff to walk them through the entire process, reducing the stress and work needed to come to the right decision. Let MBhealth do what we Love to do and you focus on your business.

Navigating Affordable Care Act (ACA) Requirements for Small Businesses

The Affordable Care Act (ACA) has established several regulations that must be complied with when a small business is going to offer health insurance. For example, group health plans must provide essential health benefits such as emergency care, prescription drugs, and preventive care.

However, though the ACA offers Guaranteed Issue coverage options for Small Business it does not mean it is always the correct choice. There are other types of plans that work inside the framework of the ACA but allow for some different evaluation methods and understanding all these scenarios is MBhealth’s job for you.

How to Consider and Calculate Financial Benefits for the Employer

Health insurance is often one of a small business’s biggest costs. To calculate the benefit to the company, it’s important to weigh immediate costs against long-term financial benefits. There are tax advantages for the company which can help offset the overall expense. Additionally, employees who take better care of their health can mean lower absenteeism and higher productivity, which supports both your company’s success and profitability.

When choosing a plan, balancing affordability with the needs of your employees is very important. Plan flexibility is very important when building a long term strategy. MBhealth will show you that the one size fits all is not always the best approach when putting together your benefit package, which can be a significant selling point when trying to attract top talent.

MBhealth Helps You Implement the Plan by Working Directly with Your Staff

When you have selected the best benefit package, MBhealth will help you with implementation. This involves not only enrolling your employees but also the education ensuring they understand the benefits available to them. Clear communication is key to helping employees make the most of their health insurance.

Effective communication can lead to higher employee satisfaction and better utilization of the benefits you’re providing. The employees take optimum advantage of their benefits and the employer gets credit for a useful benefit.

Good Service Means Helping with Adjustments and Evaluations

As your business grows and changes, the health insurance you offer may need to change as well. MBhealth continues to provide service by assisting with reviews of the plan’s performance. Whether you need to assess employee satisfaction, change your plan or adjust premiums, we are ready to help review the options and create a strategy to implement.

What Our Clients Say

EMPLOYERS SMALL GROUP Frequently Asked Questions

This depends on what overall benefits are offered to the group. Benefit package development strategy is a key component when looking to achieve a good result. Some things to consider are:

- Do you want to offer varying levels of deductibles, copays and coinsurance to offer choice and cost control?

- Do you want to create different values with, say, a Health Savings Account or a Health Reimbursement Arrangement?

- Do ancillary benefits such as dental, vision, life, short term or long term disability allow your employees more options to create value?

- Does a Flexible Spending Account (FSA) make sense?

- Would accident plans such as AFLAC be benefits that interest your employees, with the added benefit that you would not be required to pay anything?

To simply explain what small business health insurance covers is very hard to do. As you work with a health insurance consultant, they will be able to discover your needs, such as whether or not prescription benefits mean more than deductibles. Or if a voluntary life option would give employees access to coverage they would not otherwise have available. The last thing you want to do is only look at the surface of the benefits. Like anything, health insurance is a layered product and each layer is important.

In Missouri, there is no legal requirement for a small business (50 or fewer full-time employees) to provide health insurance like there is for some other types of insurance such as Workers’ Compensation or liability insurance. The decision is up to the owner of the business.

Adding the right health insurance benefit can be a complex and time-consuming task. It can be difficult to navigate the complexities while a company’s owner and executives are focused on expanding and becoming viable. Many small business owners wait until they can easily afford this cost or until it becomes vital for the company’s competitive position in the marketplace.

The services of an insurance consultant can greatly reduce the complexity of adding health insurance benefits. A consultant can learn the owner’s intentions and desires for health insurance benefits and the financial situation of the company and turn these factors into the right plans.

There are many pieces of the Insurance Pie that need to be accounted for and this is part of the value an insurance consultant brings to the table. It’s also possible to overbuy (buy too much coverage) or underbuy (buy so little that it’s not valued by the employees). Experienced support prevents this from happening.

When a person has a high-deductible health insurance plan, they may qualify to also couple it with a Health Savings Account (HSA). Funds contributed to an HSA may be applied to deductibles, co-pays, coinsurance or other costs that help a person stay healthy. HSA plans allow the insured person to pay for these expenses with tax-free dollars, in turn helping your employees get more out of every penny spent.

HSA funds can be used to cover dental and vision costs, as well as over-the-counter drugs, feminine hygiene products, blood pressure monitors, CPAP machine supplies, medical aids and many other products and services.

Funds in an HSA roll over from year to year, allowing a person to accumulate funds for a major health condition that might develop in the future.

Employers can contribute to employees’ HSA if they wish and many do. However, the funds are owned by the employee and remain with that individual even if they leave the company. There are limits to the maximum contributions that may be made to these accounts, set by the IRS. If you are thinking this sounds like a great strategy, the correct implementation of the concept is vital. Using a health insurance consultant helps maximize the HSA benefits for your employees.

Both PPOs and HMOs are types of health insurance that can be provided to employees of small businesses. A PPO is a Preferred Provider Organization and an HMO is a Health Maintenance Organization. There are different advantages to each one.

A PPO usually has a larger pool of providers for the employees without requiring any referrals while also adding some out of network coverage capability. Premium costs can be higher while the benefits may be the same. Typically an employee on a PPO plan will have more coverage while traveling away from their usual service area. This just creates a greater feeling of flexibility.

With an HMO, the employee and anyone else covered under the policy must see only those providers in the network (unless, of course, they want to pay out of pocket). There is no Out of Network coverage availability. In this instance as well, any time the member wants to see a specialist, they must obtain a referral from their primary care physician first. These reasons are why you can see a reduction in the cost for this type of policy. HMO plans also do not travel as well outside of the service area like PPO plans do.

Many people believe that with HMO plans, those who are covered lose the freedom of choice. It’s possible to get that impression if the differences and advantages of each are not clearly explained before the decision is made. Health insurance consultants can explain the benefits and advantages of each type of plan so that surprises can be minimized, resulting in greater satisfaction with the type of plan chosen.

The first five years of a new business are critical. Building an employee benefit package is not an overnight process. The needs of every business are different so you might want to wait a little while after your opening day to begin budgeting for a health insurance benefit for your staff. This is true for most small businesses (with 1 to 50 employees) but it could be a different situation for a small business with a need to recruit specially skilled or talented employees. In that situation, even a small company may need to offer health insurance to be competitive.

Most small companies wait a while before offering this benefit, even though it is popular with 84% of employees consulted in a recent survey. Companies must be up to a certain point of expansion and viability to add this expense to their budget. If the market is not as responsive as the owner hopes, it might be necessary to eliminate this benefit in the future. Once employees have health insurance, it is never popular to eliminate it. That move could lead to employee attrition which can make it more difficult for the business to be viable.

When it’s time to start thinking about adding or creating a benefit package, this is when you need to be sitting down with a health insurance consultant. There are tax advantages to the company, so your financial advisor should be part of the decision process as well. We know that your business is the dream you are bringing to life. Securing the right benefits for you, the owner, as well as for the employees you dearly care about is not a decision to rush.

The answer to that question depends on a number of factors.

- How many employees will be covered by the insurance?

- Are they low-income or high-income employees?

- Can these employees get a better price by applying for health insurance under the Affordable Care Act (Obamacare)?

- Is the company in a financially stable and viable condition?

- Would a high-deductible, low-premium plan work better for these employees than a low-deductible, high-premium plan?

- Would a Health Savings Account help your employees save more money?

It is very tough for a small business owner to work their way through these and many other questions. That’s why an insurance consultant can be a very valuable resource at this time. A consultant can easily take these and many other factors into consideration and present the business owner with the best choices. This service can save the owner hours of research and months of worry.

There’s no simple answer that is right for every business. The best thing a small business owner can do is to find someone who will work for him (not an insurance company) and share all the relevant information the consultant needs. Together, they can work with both economic and human factors and develop the right answer.

When you begin to look into adding a health insurance benefit to your small business, you’ll encounter many different options. There are, for example, three main classes of health insurance appropriate for small businesses: multiple-plan choices, Health Savings Accounts and minimum essential coverage.

Many insurance carriers offer small businesses several options that their employees can choose from. An employee can choose from a high-deductible, low-premium plan or a low-deductible, high-premium plan, depending on their needs for medical care.

Health Savings Accounts in addition to basic health insurance can help make co-pays, coinsurance and deductibles more affordable because they can be paid with tax-free funds. Companies contribute to the money placed in these accounts by the employees.

Minimum essential coverage relates to group health insurance that meets the minimum health insurance coverage set out in the Affordable Care Act.

Other categories of health insurance include ones that are set up as follows:

- Health Maintenance Organization (HMO) plans: Providers must be in-network or all costs must be covered by the insured person.

- Preferred Provider Organization (PPO) plans: Providers outside the network are allowed.

- Exclusive Provider Organization (EPO) plans: Hybrid of HMO and PPO, there are more providers in the network and referrals may or may not be required.

- Point of Service (POS) plans: You’ll need a referral from a primary care physician to see a specialist but slightly higher premiums enable you to see a practitioner who is out of network.

Not at all. In fact, it might not be appropriate for a small business owner to offer health insurance benefits as soon as the business launches. This decision must be made based on the type of employees the business needs to attract as well as the financial situation of the owner and company.

In Missouri and many other states, there is no legal requirement to offer health insurance benefits when the company has 50 or fewer employees. This gives the owner time to grow the company to greater financial viability.

Also, choosing the right health insurance benefit is a time-consuming project that often must be tackled by the owners themselves if there is no full HR department available.

Most carriers also have minimum requirements that need to be met before you can just start a plan. Having a plan in effect the very day you launch your business is not typically how it happens. You need to work through the carrier’s requirements carefully so that you do not extend the idea of health insurance availability too early. The reason for this is noted in a survey of employees where it was found that 84% of them rated health insurance as the job benefit they wanted most.

Employees with good health insurance benefits are generally more satisfied and can be retained for a longer period of time. Therefore, it is a smart move by a business owner to offer this benefit as soon as financially feasible. When it is financially feasible, that’s when you want to work with a health insurance consultant.

The decision whether or not to offer health insurance to the employees of your small business depends on the typical pay of your employees. If you have higher-income employees, offering a group health insurance plan is a very attractive benefit. It makes the company more competitive and attractive to prospective hires. You can attract better employees and retain them longer. Your staff have no obstacle to keeping themselves healthy which can mean less absenteeism.

It is important for a business owner to understand that once you decide to offer health insurance, you are also taking on the responsibility of choosing what you believe is the best plan for an overall benefit package. It is hard to make every employee happy with the plans you select. Having a health insurance consultant guide you through the process of balancing the needs of the group with the financial condition of the company is very important. You do not want to be alone in the process.

If your employees’ average yearly incomes are on the lower end, they may find more affordable health insurance under the Affordable Care Act (also called Obamacare or the Marketplace). That’s because those with lower incomes are often eligible for federal subsidies that lower their premiums, sometimes to zero dollars out of their pockets. Here too, when a business owner has a health insurance consultant who can guide them through these complexities, the decisions become much easier.

With recent changes in laws, health insurance is considered by most people to be a necessity. When a business can offer this benefit, there are advantages for both the company and the employees. Like any part of a benefit package, you always want to bolster it, not subtract from it. Let us help you with those decisions.

BOOK A CONSULTATION

MBhealth understands the many intricacies of group health insurance. We are committed to helping both individuals and businesses get the right coverage at the best price. When you need a Small Business Health Insurance Agent in St. Louis, Missouri, or Illinois, call (314) 544-5400 or fill in the form below to schedule your consultation. We’ll help you find the best plan for your small business.

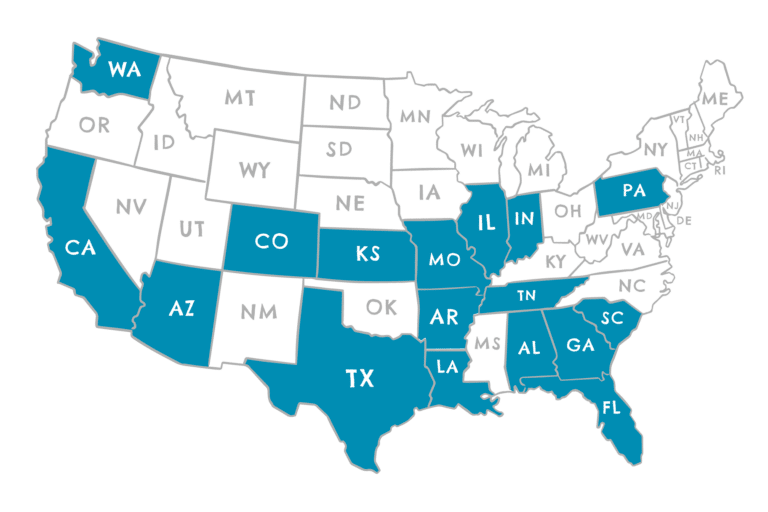

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington