MISSOURI CHAMBER BENEFIT PLAN

YOUR BEST COVERAGE FOR EMPLOYEES

The Missouri Chamber Benefit Plan is currently an excellent plan for small businesses in Missouri that may help them lower the cost of doing business while improving benefits for their employees. This plan offers a unique opportunity for small businesses in Missouri to provide comprehensive health insurance coverage to their employees while managing costs effectively.

For many small businesses, a health insurance benefit is the company’s largest cost after payroll. This plan helps a company offer competitive benefits without the financial burden often associated with traditional health insurance plans.

Missouri small businesses that choose this benefit for their staff are part of a Multiple Employer Welfare Arrangement (MEWA). Small businesses pool their risks with many other employers, reducing the costs to each company. Employers’ financial protection is backed by The Health Plan (THP) with access to the Blue Access Choice network.

What Sets the Missouri Chamber Benefit Plan Apart?

The Missouri Chamber Benefit Plan is distinct from other health insurance options available to small businesses. Pooling their risks with numerous other employers results in significant cost savings. This plan can therefore offer lower premiums than what many small businesses might find on their own in the open market.

Another beneficial feature of the Missouri Chamber Benefit Plan is its ability to minimize rate increases. Traditional health insurance plans often come with unpredictable and sometimes steep annual premium hikes, which can strain a small business’s budget. However, the Missouri Chamber Benefit Plan is structured to keep these increases as low as possible, offering financial predictability and stability for employers.

The Missouri Chamber Benefit Plan Controls Costs and Improves Employers’ Benefits

For employers, the Missouri Chamber Benefit Plan offers several advantages that go beyond just cost savings. Firstly, by providing access to a high-quality health insurance plan, small businesses can attract and retain top talent. This improves the company’s position in a competitive market.

Additionally, the plan provides employers with peace of mind. Inclusion in a Multiple Employer Welfare Arrangement alleviates a company’s risk and financial burden. Employers also benefit from the backing of The Health Plan (THP) and the extensive Blue Access Choice network, which ensures that employees have access to a broad range of healthcare providers and services.

To enroll in this plan, the company must first be a member of the Missouri Chamber of Commerce and a local Chamber such as the Affton-Lemay Chamber of Commerce in our area. Next, the business must have between 2 and 50 employees who are eligible for health insurance. There are multiple plans to choose from that may include options for Health Savings Accounts plus dental or vision coverage.

Unique, Cost-Saving Advantages for Employees

Employees have a chance to access the same health insurance benefits from the Missouri Chamber Benefit Plan that are available with other Carriers but at times significantly lower premiums. Access to the Blue Access Choice network means that employees can choose from a wide range of healthcare providers, ensuring that they receive the care they need without being restricted to a network that is too small or limited. This flexibility can appeal to employees who may have specific healthcare needs or preferences as well as those that live out of state.

When an employer sets up these health plans for their employees, there are options to add dental and vision coverage. The offerings also have plans that are Health Savings Account compatible, which create opportunities for employees to save money on taxes.

Both employees and employers’ benefit from being part of a MEWA plan as this group approach to providing health insurance can help minimize rate increases. While many employees may worry about rising healthcare costs, being part of a plan designed to control these increases can ease some of these concerns. This stability translates to fewer disruptions in coverage and more predictable out-of-pocket expenses for employees and their families.

Comparing the Missouri Chamber Benefit Plan with Other Health Insurance Options

Other small group plan options outside of the Missouri Chamber Benefit Plan may not provide the same level of cost control techniques. Other small group plan offerings can be subject to market fluctuations differently without the ability to spread the risk over a larger segment of employees, which can lead to higher premiums and unpredictable rate increases which are hard on both employers and employees.

The Missouri Chamber Benefit Plan strikes a balance by offering the cost savings and risk management of a large group plan, designed specifically to provide small businesses with excellent benefits and competitive advantages. For personalized help designing the perfect plan for your employees, call MBhealth Insurance Agency at (314) 544-5400 today!

A Comprehensive Solution for Small Businesses in Missouri

The Missouri Chamber Benefit Plan stands out as a comprehensive solution for small businesses in Missouri looking to provide high-quality health insurance to their employees. By minimizing rate increases, offering a broad network of providers, and allowing businesses to pool their risks, this plan offers a unique combination of benefits that may not be available elsewhere.

For businesses interested in learning more about how the Missouri Chamber Benefit Plan can work for them, contacting a knowledgeable consultant is the next step. MBhealth is ready to assist with finding the perfect fit for your company’s needs, ensuring that you can offer your employees the best possible benefits while managing costs effectively. Reach out today for a consultation and take the first step towards a more secure and cost-effective health insurance solution for your business. We are ready to find the perfect fit for your needs. Call us at (314) 544-5400 for your consultation or fill in the form below.

If there are any complexities to your situation such as pre-existing health conditions, assets or COBRA coverage, we’ll walk you through the process so you can make the best choice.

What Our Clients Say

MISSOURI CHAMBER BENEFIT PLAN Frequently Asked Questions

As the name implies, this insurance is only available to small businesses in Missouri. The business must be a member in good standing of the Missouri Chamber Federation. If the small business is headquartered in Missouri with offices outside the state, the out-of-state employees can also be covered by this insurance.

This insurance is available to small businesses with between 2 and 50 employees who are eligible for health insurance benefits. Each insured person can count on fixed and predictable monthly premiums. Missouri Chamber Insurance offers a wide variety of choices for small businesses and can also offer employees of one company more than one plan to choose from. There are also multiple health plans that offer traditional Health Savings Accounts. Options are also available for dental and vision benefits.

This type of insurance constitutes a Multiple Employer Welfare Arrangement (MEWA), meaning that multiple small businesses pool their risks and lower their costs. The plans are administered by Anthem Blue Cross Blue Shield. To get help enrolling your small business for Missouri Chamber Insurance, call MBhealth today.

The basic Missouri Chamber insurance plan does not automatically include benefits for dental and vision care. But there are options to add dental and vision benefits for your employees. In fact, if your group bundles medical insurance with dental and vision, you may be eligible for a discount off the medical insurance rates.

These plans include a strong network and coverage options for dental and vision. They also offer great features like 100% coverage for preventative care. Major services can be obtained without waiting periods.

All plans are administered by Anthem Blue Cross Blue Shield. For help with all the details involved in signing up your small business for Missouri Chamber Insurance, please call MBhealth.

The Missouri Chamber Benefit Plan has Preferred Provider Organization (PPO) plans that include Health Savings Accounts available to small employers who want to offer their employees health insurance benefits. The HSAs are administered by Central Bank which provides accounts that work seamlessly with the Chamber Benefit Plan.

These HSAs offer your employees tax savings on funds that are used to pay for qualified medical, dental, and vision expenses. The bank issues a debit Mastercard to make it easy to access the funds and keep track of payments. Central Bank has a self-service portal available to each insured person so they can easily monitor their payments and balances. This portal is also available through the bank’s mobile app. The bank even offers webinars to help insured employees understand how these accounts work to save them money.

The result is better benefits for employees and lower costs for companies. Call MBhealth in St. Louis for help getting your company enrolled.

A Multiple Employer Welfare Arrangement (MEWA) is, in essence, an association of small businesses that come together to offer their employees health insurance benefits. When small businesses of two to 50 employees join together this way, they act as one large company so they can find a way to keep benefits and prices stable over multiple years.

These plans are medically reviewed per application to determine if there is the possibility of obtaining better prices on health insurance than those employees could get under the Affordable Care Act.

Having the ability to spread the risk over thousands of members creates a very competitive option for small businesses that seek to offer health insurance benefits to employees.

If you’re interested in getting your Missouri employees covered under Missouri Chamber Insurance, call MBhealth today.

For small businesses in Missouri, the Missouri Chamber Federation offers an excellent way to obtain health insurance benefits for employees at an affordable price. This benefit is available through Blue Access, Blue Access Choice and Blue Preferred health networks through Anthem. As long as you have between two and 50 employees eligible for health benefits and your company is a member of the Missouri Chamber Federation, you may be able to use this strategy for your company benefits.

Get help determining which of these nearly two dozen plans is perfect for your company and employees. Talk to the experts at MBhealth today to get your company enrolled.

There are a few differences between the MEWA plans and non-MEWA plans. MEWA plans were developed as a way to bring back some of the earlier methods of underwriting for small groups prior to the Affordable Care Act/Obamacare. These plans also filled a gap between level funded strategies (a type of partially self-funded health insurance plan) and the ACA.

To be eligible to take advantage of a MEWA plan, a company must belong to one of the Missouri Chambers of Commerce. Once the company is a Chamber Member, they not only have access to MEWA plans but also a way to connect with the community served on a more personal level. The Chamber offers a way for multiple businesses to have more combined power when working for the rights of Small Business Employers.

Additionally, there’s a real advantage to being joined with hundreds of groups. This advantage comes at MEWA plan renewal time each year. When the company initially joins the MEWA plan, they are rated based on their personal characteristics. But next year at renewal time, they are considered a member of the whole pool of groups enrolled in the MEWA Association. In most cases, this membership results in more stable rate renewal increases year over year. This can be a very good planning tool come budget time.

Another major difference between MEWA and non-MEWA plans is that MEWA plans are only available with Anthem Blue Cross Blue Shield of Missouri. A company cannot stay with United Healthcare, for example, and also be part of the MEWA plan. The Missouri Chamber Federation has worked with Anthem Blue Cross Blue Shield to be the only carrier for MEWA plans. Under Anthem Blue Cross Blue Shield, network availability and product options are just as robust as with any other carrier offering group health insurance.

Knowing how to take advantage of the MEWA plans is important. Having a Health Insurance Consultant like MBhealth to help with your choices can be a real benefit by saving you both time and money.

Your company can join together with many other small businesses and act very much like one very large company as you acquire health insurance coverage for your employees. A MEWA plan generally offers more rate stability year over year because of this combined buying power.

With Affordable Care Act/Obamacare group plans, these plans are guaranteed issue which means that whether the members of the group are healthy or not, the enrollment must be offered. Rates with guaranteed issue may be extremely high.

In between ACA plans and MEWA plans, there are level funded plans that are a type of partially self-funded health insurance plan. Level Funded plans could have more volatility at the time of renewal because they are not part of a larger association that can help stabilize and even out some of the overall increases.

Finally, for a century, the Missouri Chamber of Commerce and Industry has been taking care of business for Missouri employers in the halls of the State Capitol, in the courtroom and beyond. Empowered by a deep passion for the cause of small businesses and a strong network of professionals, the Missouri Chamber brings together members from all corners of the state to make Missouri a better place to live and work. Being part of that is just another benefit in addition to the benefits of the MEWA plan itself.

If you are ready to enroll your company in a MEWA plan, contact MBhealth and make the process faster and easier.

For a century, the Missouri Chamber of Commerce and Industry has supported Missouri businesses and employers through actions taken in the State Capitol, in courtrooms and in communities. The Missouri Chamber has been driven by their passion to help small businesses by empowering a strong network of professionals to forward this cause. The Chamber is always looking for new and innovative ways to improve the communities they are part of. Since 1923, they have helped make Missouri a better place to live and work.

Further, by helping small businesses in Missouri acquire competitive health insurance benefits and prices, the Missouri Chamber Federation supports the growth and viability of small businesses throughout the state. These small businesses can then offer benefits that are competitive with those of larger businesses, which may improve that company’s ability to recruit and retain skilled staff. A MEWA plan with good benefits and a broad network of healthcare providers can help one small business stand out over others in the same market.

Working with a Health Insurance Consultant who can help you navigate the options is a very important way to make sure you get the most advantages and savings for both the employees and the company. Call MBhealth for the guidance you need as you acquire this health coverage for your employees.

GET A CONSULTATION

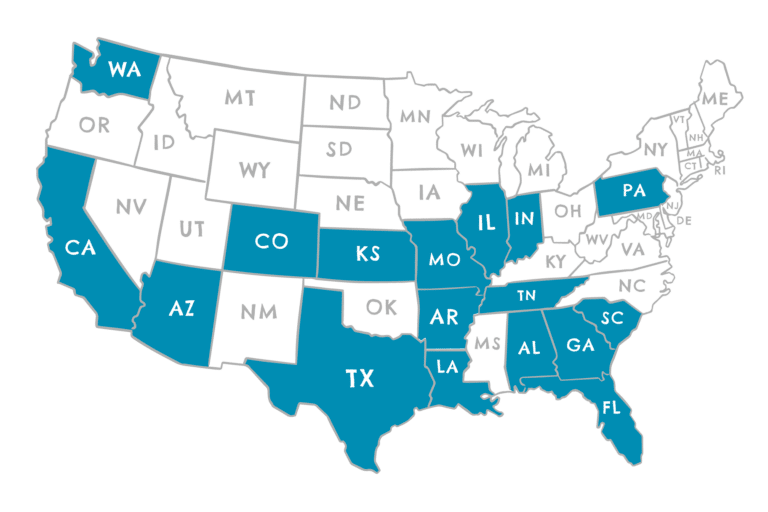

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington