MEDICARE HEALTH INSURANCE

GET THE RIGHT COVERAGE WITH MBHEALTH

After you turn 64, it’s time to start thinking about Medicare. In some cases, Medicare may even be available before the age of 65. MBhealth is a leading Missouri and Illinois Medicare Insurance agency.

There are many questions that need to be answered to get a person the right Medicare coverage.

- What has that person’s coverage been like up to now?

- What kind of assets do they have?

- What do they expect from their healthcare?

- Are there specific doctors this person wants to see?

- Are there certain medications that need to be covered?

- What are their future plans like?

- What is your employment status?

When answers to all these questions are known, we can match that individual with the right coverage. It takes experience with the financial and legal aspects of Medicare to help a person make the exact right choice.

WE CARE ABOUT YOU

At MBhealth, we are here to counsel each client through each of the insurance choices they need to make, including Medicare, Medicare Supplement Insurance, Medicare Advantage or other policies. We also advise our clients with recommendations when the Annual Enrollment periods come around or their life situations change.

The Importance of Your First Enrollment with Medicare

As you approach your 65th birthday, start making plans to apply for Medicare. This health insurance is primarily available to individuals who are 65 years of age or older, but certain younger individuals may also qualify under specific conditions. For instance, a younger person who has received Social Security Disability Insurance (SSDI) for at least 24 months or was diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS), is eligible for Medicare coverage.

If you are enrolling at 65, it’s important to know the deadlines related to your enrollment to avoid penalties and ensure access to healthcare services when you want them.

- The Initial Enrollment Period (IEP) is the period in which you can enroll in Medicare. You have a seven-month window that begins three months before the month you turn 65, includes your birth month, and continues for three months afterward.

- During this period, you can sign up for Medicare Part A (hospital insurance) and Part B (medical insurance). If you’re already receiving Social Security benefits, you will be automatically enrolled in Parts A and B, but you can choose to delay Part B if you have comparable coverage, such as a group plan from an employer.

- If you miss this initial signup period, a General Enrollment Period (GEP) runs from January 1 to March 31 each year. Coverage will start July 1. However, missing the IEP can result in penalties for late enrollment.

- There is also a Special Enrollment Period (SEPs) which applies to individuals with qualifying life events, such as losing employer coverage. Understanding when and how to apply is vital for securing the benefits you need without penalties, delays or lack of coverage.

For help navigating the complexities and deadlines of Medicare enrollment, contact MBhealth at (314) 544-5400 today!

Understanding Medicare Parts A, B, C, and D

Medicare is divided into four primary parts, each covering different aspects of healthcare. If you are just beginning your enrollment in Medicare, it is important to understand the differences so you can have the coverage you want.

Medicare Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. Most people don’t pay a premium for Part A if they or their spouse have paid Medicare taxes while working.

Medicare Part B is medical insurance. It covers outpatient care, doctor visits, preventive services, and certain home health services. Part B requires a monthly premium.

Medicare Part C is referred to as Medicare Advantage. These plans are offered by private insurance companies approved by Medicare. Medicare Advantage bundles Medicare Parts A and B and often also includes prescription drug coverage (Part D). It may include vision and dental coverage. It’s important to compare plans carefully because they will each have different networks of providers and out-of-pocket costs.

Medicare Part D is prescription drug coverage which helps cover the cost of medications and is available through private insurance companies. You can purchase a standalone Part D plan in addition to Medicare coverage, or it may be included in a Medicare Advantage plan. Enrolling in Part D when you’re first eligible is very important as late enrollment penalties can be severe.

About Coverage With Both Private Insurance and Medicare

It is possible to have coverage for medical expenses through both private insurance and Medicare. Additional coverage can complement a person’s Medicare benefits to reduce out-of-pocket expenses or cover services that Medicare doesn’t fully pay for.

If you have coverage through your employment or that of your spouse, your employer insurance may be the primary payer for your medical costs, and Medicare may act as the secondary payer. This means that Medicare may cover costs not fully paid by your employer plan, such as copayments or deductibles.

If you enroll in the original Medicare plan rather than Medicare Advantage, you can look for a Medicare Supplement Insurance, also known as Medigap, to help you cover healthcare costs not covered by Medicare.

What Our Clients Say

MEDICARE Frequently Asked Questions

Medicare is only available to those who have reached age 65 or older. At that time, they are eligible to receive Medicare Part A, hospitalization insurance, without needing to pay a premium due to paying Medicare taxes and have at least earned 40 quarters. It’s also possible to qualify for Medicare because of disability, End Stage Renal Disease or Amyotrophic Lateral Sclerosis.

Medicare costs are covered through payment of payroll taxes under the Federal Insurance Contributions Act (FICA), paid during that person’s working years. These funds cover the cost of both Social Security benefits as well as the premium for Medicare Part A.

Medicare Part B is Medical Insurance. This is a voluntary program and there is a premium due to obtain this Medicare coverage. If a person is already receiving Social Security benefits, this premium will automatically be deducted from their benefits. There is a deductible applied before Medicare Part B begins to pay for medical costs. This amount may vary from year to year.

There are many other variables related to enrollment in Medicare Part A and B and the advice of an experienced insurance consultant may be valuable in helping you determine if you are qualified to enroll. Contact MBhealth if you need assistance obtaining health insurance through Medicare.

A person receiving Medicare must be 65 years old or older. They must also have worked for enough quarter-years in an employment situation where FICA deductions were made.

If a person has been receiving Social Security benefits for at least four months before they turn 65, they will automatically be enrolled in the Medicare program. If you are not receiving Social Security benefits you must enroll.

Some people can get coverage under Medicare before age 65 if they are disabled, have End-Stage Renal Disease requiring either dialysis or a transplant, or if they have Amyotrophic Lateral Sclerosis (Lou Gehrig’s disease).

To enroll in Medicare Part B, an individual must be an American citizen or an alien who has been lawfully admitted for permanent residence and lived in the U.S. for five continuous years.

What can make Medicare enrollment so complicated is that there are many other laws applying to who can receive medical insurance under Medicare and when they can enroll. While the basics of Medicare are fairly simple, there is much more to know about eligibility and enrollment. For expert help enrolling, please contact MBhealth.

Medicare Part A is hospitalization insurance only. When a person qualifies for Medicare and reaches the age of 65, they do not pay a premium for this coverage.

Medicare Part A covers hospital stays, care in a skilled nursing facility, hospice care or home health care. Medicare Part A does not cover doctor’s visits, or other professional fees even those visits while you are in the hospital.

There are many types of care that your doctor may order while you are in the hospital that will be covered by your Medicare Part A. This includes inpatient treatments such as lab tests, MRIs and surgical costs. If you need rehabilitation after surgery, illness or injury, Part A will cover your stay at a skilled nursing facility.

If you are in the hospital for cosmetic surgery, Medicare Part A will not cover these costs. It will also not cover outpatient surgery but these costs will be covered by Medicare Part B.

It is important to note that there are some limits to this coverage. A one-time deductible applies to all your hospital services for the first 60 days you’re in a hospital. If you are in the hospital more than 60 days you will pay a per day copay.

Medicare Part B is medical insurance covering doctor’s services, outpatient care, other professional services, and medical supplies. Officially, according to the Centers for Medicare & Medicaid Services, Part B covers “services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.” It also covers some preventative services such as examinations, lab tests and screenings. There is typically a premium of $175 a month due to maintain Part B coverage, but this amount changes every year. If you have a high income, you may pay more.

Medicare Part B normally covers outpatient x-rays, casts, stitches, along with durable medical equipment such as CPAP machines, wheelchairs, canes, diabetic supplies and hospital beds. These must be medically necessary and prescribed by your physician.

The type of medical practitioners covered include medical doctors, clinical nurse specialists and nurse practitioners, occupational therapists, physician assistants, physical therapists, speech therapists, and, in some cases, dentists, optometrists and Doctors of Chiropractic.

Ambulance services are also covered by Medicare Part B, as are mental health services such as counseling and evaluations. An annual deductible and coinsurance apply to all types of treatment and visits.

If you don’t sign up for Part B when eligible and do so later you may have to pay a penalty unless you have creditable coverage.

Medicare Part C is a Medicare Advantage Plan. These are typically HMO or PPO plans offered by private insurance companies that have contracts with Medicare. These alternatives to government-offered plans include the same coverage offered by Medicare Part A, Part B and, in most cases, Part D or prescription drug coverage.

With a Medicare Advantage Plan, you will have one policy that applies to all your inpatient or outpatient care, plus prescription drug coverage, as long as those medications are included in the plan’s official formulary (list of covered drugs).

These plans typically offer coverage for dental, vision and hearing care, with limits. The exact coverage and costs vary from one plan to the next, and from one state to the next.

It is also possible to access fitness classes at no additional cost, plus over-the-counter medications and health maintenance supplies. Companies providing these supplies or services receive payment directly from Medicare by contract.

To obtain Medicare Part C coverage, you will need to pick a plan that is in effect in your area. Emergency care outside the plan’s service area is also covered, and are enrolled in Medicare Part A and Part B.

Benefits change from year to year, which can make maintaining optimum coverage difficult. For guidance and advice on your best coverage under Medicare Part C, please contact MBhealth.

Medicare Part D is prescription drug coverage. It is optional coverage available to anyone who has enrolled in Medicare Part A and Part B. It is important to consider carefully whether or not to include Medicare Part D coverage when you first enroll in Medicare. If you do not choose this option and you do not have any other prescription drug coverage (such as coverage under an employer’s or union’s plan), you may be liable for a penalty added to every Medicare premium paid in the future. This is called a Late Enrollment Penalty (LEP).

Before deciding to obtain Medicare Part D coverage, compare any current prescription drug coverage you may have now (through your employer, union, Veterans Affairs, TRICARE or other organization) to the coverage available under Medicare Part D. Your coverage through one of those insurers may change once you have Medicare so you should talk to the benefits administrator or insurer before making your decision to make sure those benefits are considered as good as Medicare’s Part D plans.

If you plan to sign up for a Medicare Advantage Plan (Medicare Part C), prescription drug coverage is normally included. The medications covered must be listed in the plan’s formulary.

There are many details involved in choosing the best care for your financial and health situation. Talking with an insurance consultant at MBhealth can help you make your best decision.

Many people have more than one type of insurance. This can happen when they continue to work past 65 years of age. Their private coverage may come from a group health plan, retiree benefit or Medicaid. In this situation, there are rules to determine which provider pays for medical expenses first, second or occasionally, even third so call your agent to find out about your situation.

With Medicare Part A and B plus employer coverage, Medicare would be the primary payer for your health expenses if your employer has an average of less than 20 employees. . Then your insurance through your employer will pay for costs not covered by Medicare Parts A and B. For employers with more than an average of 20 employees Medicare is secondary.

With certain types of health insurance, such as TRICARE and CHAMPVA, you are required to enroll in Medicare Parts A and B to keep your coverage.

If you have medical coverage that is equal to or better than Medicare when you reach 65, enrolling in Medicare is optional. If your coverage is not equal to Medicare coverage, you may face penalties when you finally enroll in Medicare. This penalty will increase the longer you wait. It is important, then, to do your homework thoroughly before you reach 65. If you need help navigating these choices, please call MBhealth.

In general, Medicare is available to Americans when they turn 65 years of age. But there are many other categories of eligibility.

Individuals are eligible for Medicare at an earlier age if they are disabled, have End-Stage Renal Disease (meaning they have permanent kidney failure requiring transplant or dialysis), or they have Amyotrophic Lateral Sclerosis (Lou Gehrig’s disease).

Other categories of possible eligibility:

You are younger than 65 but have been entitled to or receiving Social Security disability benefits for at least 24 months

You receive a disability pension from the Railroad Retirement Board.

You are a government employee or retiree (or their spouse) who has paid Medicare payroll taxes.

You are an American citizen or a permanent legal resident who has been in the United States for at least five years.

In many of these situations, there are additional requirements that must be met.

As you can see, there are many details affecting your eligibility for Medicare. To clarify your situation and get the best coverage, please contact us at MBhealth for a consultation.

Each person becoming eligible for Medicare has a seven-month period in which they can enroll for this coverage. This is called the Initial Enrollment Period. This period begins three months before the month they turn 65 years of age. It ends three months after that month.

If a person misses enrolling in this seven-month period, they are likely to have to wait to sign up for Medicare. They may also incur a late enrollment penalty for as long as they maintain Part B coverage. This penalty will increase the longer they wait to enroll.

If a person has other coverage that is comparable to Medicare, such as through a group plan from an employer, they are not liable for these penalties as long as the coverage is considered creditable by Medicare.

As you can see, there are many laws, details, exceptions and variables related to obtaining medical insurance through Medicare. To be sure you avoid penalties and get the best coverage, please consult with MBhealth well before you turn 65.

Basically, changes to your Medicare policy must be made during the Annual Enrollment Period which extends from October 15th to December 7th. You can add or subtract plans at this time and their coverage will become effective the following January first. You can also switch to a Medicare Advantage Plan or return to Medicare Plans A and B and discontinue your Medicare Advantage Plan. Enrollment into a Medicare Supplement is not automatic and often requires medical underwriting.

Outside this Open Enrollment Period, you must meet some very specific exception requirements to make a change. There is quite a long list of these exceptions so if you have any situation similar to those in the following list, you would be wise to consult with one of the experts at MBhealth before taking any action:

- You are moving back into the U.S. after living outside the country

- You have lost coverage because you left your employer

- You have Medicare Plan C and you moved out of the plan’s service area

- You have a severe or disabling condition and there is a Medicare Chronic Care Special Needs Plan available for this condition

- You’ve just been released from jail

- You have just moved into or out of a long-term care facility

Need help? Contact MBhealth to clarify your options.

Get the Help You Need to Make This Important Process Simple

Navigating the complexities of health insurance is what we at MBhealth do every day. We can give you confidence as you make your choice of Medicare, Medicare Advantage or other options available to you. Don’t wait until deadlines are looming. Contact us well before your 65th birthday and we can make your enrollment simple and seamless.

Whether you’re approaching 65 or want to change your Medicare plan, let’s talk. Call (314) 544-5400 and ask for a consultation or fill in the form below. We will contact you shortly to help you meet all your deadlines and obtain the coverage that will suit your needs and lifestyle.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. We currently represent 10 organizations offering 79 plans in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options. Not affiliated with or endorsed by any government agency.

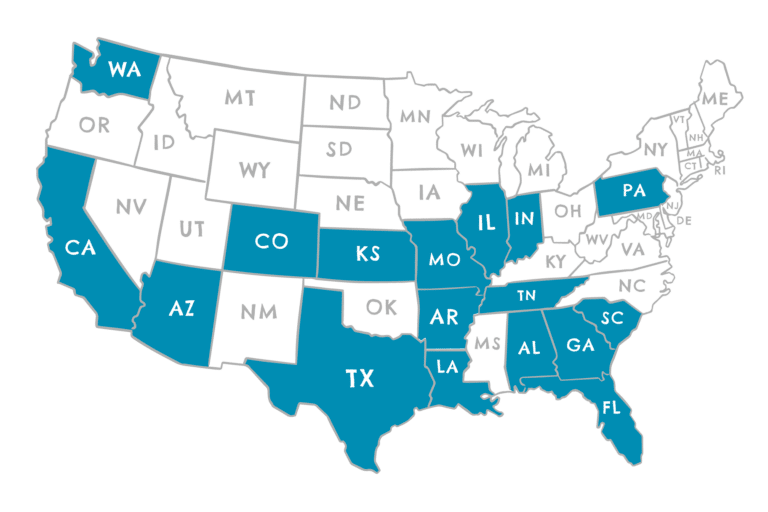

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington