LIFE INSURANCE

THE RIGHT COVERAGE FOR ANY LIFE AND ANY SITUATION

Life insurance provides financial protection for your spouse, children, and anyone else who is dependent on you. The correct life insurance policy will provide financial support for your loved ones when you are no longer able to provide for them. At MBhealth, we work with each client to help them look at their future plans and financial goals so they feel confident that they have the right amount of life insurance to care for their families or other loved ones.

How Life Insurance Can Work for You and Your Family

the premiums, the insurance company promises to pay a lump sum, called a death benefit, to your beneficiaries when you pass away. This money can be used for a variety of purposes—paying off debts, covering daily living expenses, or funding education or living expenses.

For each person, the amount and type of life insurance will be different. There are three main types: term life, whole life, and universal life. We help our clients choose the right type for their situation.

Choosing the Right Type of Life Insurance

Each of the three types of life insurance—term life, whole life, and universal life—has different provisions and is needed in different situations.

- Term Life Insurance:

The simplest and usually most affordable form of life insurance. Its coverage lasts for a specific time period, typically 10, 20, or 30 years. If you die during this time, the policy pays out to your beneficiaries. Term life is suitable for those looking to cover financial obligations like a mortgage or college tuition for children. However, once the term expires, the coverage ends. - Whole Life Insurance:

Whole life insurance provides lifelong coverage. This type of policy also provides a cash value component that increases over time. It also guarantees a death benefit as long as premiums are paid. Because of its long-term nature and additional benefits, whole life insurance tends to be more expensive than term life but it also serves as an investment tool. - Universal Life Insurance:

Similar to whole life, universal life insurance offers permanent coverage with a cash value component. It is more flexible, enabling you to adjust your premiums and death benefit as your needs change. The cash value grows based on interest rates and market performance, giving policyholders more control. Universal life insurance provides long-term coverage with the flexibility to easily adapt to changing situations.

How Much Life Insurance Do You Really Need?

Insurance agents often state that the insured person should have coverage amounting to seven to 10 times their annual salary. Your needs may require more or less. One of the services MBhealth provides for our clients is to help them look at their whole financial picture to determine how much insurance they need. Our experience helps our clients confidently make the right choices.

Take these factors into consideration when deciding how much life insurance you need:

- Income replacement: How many years of income would your family need if you were no longer around to provide for them?

- Debt obligations: Are there large debts that need to be paid off, such as a mortgage or student loans?

- Final expenses: Funeral and burial costs can add up. At this time when your family needs support, life insurance can make it possible to cover the costs without worry.

- Future goals: When there is a spouse or children, how much support do you want to provide for them? College for your children? Retirement for your spouse?

When You Need to Adjust Your Life Insurance Coverage

Life insurance isn’t a “set it and forget it” financial product. As your life changes, so should your coverage. With each change, your insurance coverage should be modified to meet your changing needs.

- When to increase coverage:

Major life changes such as getting married, having children, or buying a house can significantly increase your financial obligations. In these instances, it’s wise to increase your life insurance to ensure that your family’s needs are covered. - When to decrease coverage:

As you pay off debts, increase your savings or watch your children become financially independent, you may need less life insurance. In these cases, reducing your coverage can lower premium costs without sacrificing the financial security of your family.

We’ll help you make these calls each time you experience a change in your life.

Who Needs Life Insurance Most?

Life insurance is very important for anyone who has financial dependents or responsibilities. As soon as you have a spouse, child or other loved one that relies on your income, that’s the time to acquire life insurance. It can also be a valuable tool for business owners or those looking to leave a legacy for their heirs or a favorite charity.

It might surprise you, but life insurance is vital even for those who are single. These funds can help cover final expenses or debts or support others you care about.

Our Job: Helping You Get and Keep the Life Insurance You Need

Our job isn’t selling you insurance policies. It’s helping you make the right financial decisions that include having an appropriate amount of life insurance. To do that, we need to understand your financial situation and your goals. We take that information and fit it into a plan that includes the right amount of life insurance.

What Our Clients Say

LIFE INSURANCE Frequently Asked Questions

Life insurance is a guarantee that the insuring company will pay a certain value to the beneficiaries of that policy when the insured person dies. The death benefit is determined at the time the insured person secures the policy.

Once that person’s death occurs, the full value of the insurance policy is disbursed to the family or other beneficiary. It is commonly used to cover:

- Payment of debts

- Replacement of income lost by the person’s death

- Inheritances to loved ones

- Payment of taxes on the estate

- Donations to charities

The way the insurance benefits are distributed is normally established when the policy is obtained by naming the beneficiaries in the policy. Some people also make these allocations in their will.

When a person starts a family, life insurance for the major breadwinner becomes important. In a two-income family where both parents work, both people should be insured to prevent the hardship of losing one of those incomes.

It is important that one’s life insurance plans be included in their overall financial planning. The right insurance consultant will take all aspects of a person’s finances and future plans into account when setting up their life insurance. MBhealth can help make these decisions simple. Call us.

The correct amount of life insurance for you depends on many factors. For example:

- Are you married?

- How many children do you have?

- What are their ages?

- Do you own a home?

- Do you have a mortgage on that home?

- What is your current debt burden?

- Do you want to ensure that your children can attend college?

- What is your current income?

- What is your spouse’s income?

- What are your financial goals?

- How much do you currently have in savings?

With all these answers in hand, your insurance consultant can provide you with the right amount of life insurance that can give you peace of mind.

Another factor to take into account is whether you want term life or whole life insurance. Term life lasts only for a set period and whole life does not ever expire. Whole life is much more expensive than term life. Your current budget may determine which type of life insurance is best for you.

Some life insurance policies will enable you to convert a term life policy to a whole life policy at the end of the policy’s term. To explore all your life insurance options and make sure that your family is cared for, please call MBhealth today.

Whole life insurance is what most people think of as life insurance—you pay a premium each month and when you die, your family or other beneficiary receives the value of the policy.

This contrasts with term life insurance. With term life, you pay a much smaller premium for a set amount of time (called the term of the insurance, usually a period of 10 to 30 years). After that time, the policy expires. This type of life insurance is often chosen while a breadwinner has children to be raised and a mortgage to be paid after their death.

While whole life is quite a bit more expensive, the cash value of the policy continues to increase as long as the premium is paid. There is no expiration. There are many ways to utilize this value during a person’s retirement when a considerable value has accumulated. Some people utilize the cash value of their life insurance policy to supplement their retirement income. That practice reduces the benefit available to their heirs upon their death.

It’s very important that the insurance consultant who sets up your life insurance policy knows your financial goals thoroughly so your policy can be set up the right way. Please contact MBhealth to ensure you get the right service at this time.

Term life insurance is life insurance that pays a death benefit to your beneficiary, like with any life insurance policy, but only for the term of the policy. Many people with small children or a mortgage will choose a term life insurance policy for ten, 20 or 30 years to ensure that all their most important obligations can be covered after their death.

After that time, their obligations are likely to be much less and a high value life insurance policy is not as important.

One of the major appeals of term life insurance is that it is far less expensive than whole life insurance. Whole life insurance can be five times as expensive (or more) than term life. This means that term life may be affordable for a young family while whole life insurance might be priced out of their budget.

When choosing term life, the breadwinner can select the term of the policy. A 30-year term life policy may be chosen to ensure the remainder of a mortgage can be paid.

It is important to not let a term life insurance policy lapse. If the insured person wishes to renew a policy, a new price will be calculated based on their current age and health condition.

Universal life insurance is a type of insurance that offers more flexibility than other types. Like whole life insurance, universal life insurance does not expire at the end of a term. Instead, it builds a cash value that you can borrow against while you are alive.

Here are some further benefits of this flexible type of life insurance:

- With each premium, part of the payment goes toward the death benefit and part goes toward the cash value.

- When the cash value has accumulated, you can use this value to cover your premiums if it’s necessary for you to reduce your costs.

- You must not use more than the cash value of this policy to cover premiums or your policy may be canceled.

- Your death benefit (payout amount) will not change when you use the cash value in this way.

- Both the payout amount and growth in cash value are typically tax-free.

- The cash value can be used as collateral.

- If you choose to increase or decrease the value of the policy, you may be able to do this, although increases may require a medical exam. This contrasts with whole life policies which are fixed for the entirety of the policy’s life.

To make the right choice for your financial situation, get help from MBhealth. Call us today.

Some life insurance policies require a medical examination and others do not. The medical examination may not be as extensive as you think.

A medical examination for life insurance usually includes providing:

- Your medical history

- Current and past prescriptions

- Familial medical history (parents and siblings)

- Your driving record

- Any occupation or hobbies that are dangerous

- International travel plans, especially to dangerous locations

During the medical examination, your height, weight, blood pressure and heart rate will be recorded. Blood and urine tests will be done to check your cholesterol levels, blood sugar level and to look for the presence of nicotine or drugs.

If you are more than 50 years of age and you are requesting a high value life insurance policy, an electrocardiogram may be needed. Some insurers may also need results of an x-ray or a stress test.

The reason for a medical exam is to compare your life expectancy with others of a similar age and health condition. Once the insurance company has this information, they can calculate the expected duration of your life (when compared to millions of other people) and thereby determine the right cost for your life insurance policy. Whether you prefer a life insurance policy with or without a medical examination, contact MBhealth to obtain the policy you’re seeking.

A life insurance beneficiary is the person or people you designate to receive your life insurance policy’s death benefit when you pass away. This individual(s) will receive the policy’s death benefit but if there is a separate cash value (as occurs with a universal life insurance policy), that cash value may be retained by the insurance company.

In addition to one or more beneficiaries, you can also designate a charity or family trust to receive the death benefit. Some people decide to leave their death benefit to their grandchildren as this may provide a tax advantage.

In some states, you must name your spouse as primary beneficiary unless you get their consent to name other people. Minor children can’t normally be named as beneficiaries. Instead, you will need to set up a trust for those children to manage their finances until they come of age. You can name the trust as the beneficiary of your death benefit.

Whether or not you can change your beneficiaries depends on how your policy was originally set up and your state laws. To ensure that your life insurance policy is set up the right way to meet your financial goals while complying with state laws, contact MBhealth.

In most cases, you can either increase your life insurance death benefit or reduce it. Some insurers limit the number of times each year that you can make this kind of change.

If you increase your death benefit, you will of course also increase the amount of your premiums. You will probably not need to get another medical examination. The amount of your premium will be determined according to your age at the time you make this request.

Some people need to decrease the cost of their life insurance premiums as an economizing measure. They should be careful not to under-insure themselves and thereby fail to achieve their financial goals.

If you are thinking of increasing the value of your life insurance policy, another choice is to obtain a second life insurance policy. Insurers may look at the total value of any insurance policies you currently have before issuing another one. There is typically a limit of how much insurance you can obtain, calculated as a certain number of multiples of your annual income.

When you want to change your amount of life insurance, it’s a smart move to talk with an insurance consultant who can take financial goals into consideration when helping you make this change. MBhealth is ready to provide this help.

The fact is that every person should have some level of life insurance, even children. While it’s true that young single people usually have few obligations, there are always expenses related to a person’s passing. And even younger people may have credit cards or student debt.

Obtaining life insurance may seem a little daunting financially for young married couples just starting families. But these may be the most important years in which to have life insurance for any breadwinners in the family. The loss of the major breadwinner is often catastrophic. Term life insurance policies for this time of life can make insurance coverage more affordable.

If the insured person incurs extensive medical expenses before passing away, a life insurance policy becomes even more essential. The beneficiary can cover their final expenses without suffering financially.

For a person looking far ahead, whole life insurance may help them make their retirement years more comfortable.

Any time someone passes away, there are responsibilities left behind for family members or others who might be beneficiaries of the policy. Whether the person who is lost is young or old, the loss may be able to be dealt with a little more easily when the financial stress is alleviated. To plan your life insurance coverage, contact MBhealth for advice.

Only some types of life insurance accumulate a cash value. A permanent life insurance or whole life insurance policy will accumulate this value but a term life policy will not.

The cash value of a policy will earn tax-deferred interest as long as it is not tapped. When you have paid into this policy for an extended period of time so that the cash value is high, you may be able to withdraw some of this cash to reduce your mortgage, cover the costs of an emergency or finance a child’s college education. When you withdraw these funds, you will reduce the death benefit paid out to beneficiaries.

You may also use the cash value as collateral or borrow these funds and pay them back. While you are using the funds, your debt accrues interest just like your credit cards do. If you die before paying back the entire loan, the amount of the remaining debt is deducted from the death benefit.

There is quite a lot to understand related to life insurance and much of it relates to your state laws. To get the right advice for your financial situation and goals, please contact us at MBhealth where we work for you, not insurance companies.

Book a Free Consultation

Our caring service doesn’t stop when you acquire your policy. We’ll help you adjust your insurance as your situation changes. Whenever you experience a life change, please contact us for an insurance review.

If you are interested in life insurance in Missouri, Illinois, or another state, give us a call at (314) 544-5400 for a free consultation. You can also fill out the form below to request a free consultation from MBhealth. We will be in touch within two business days.

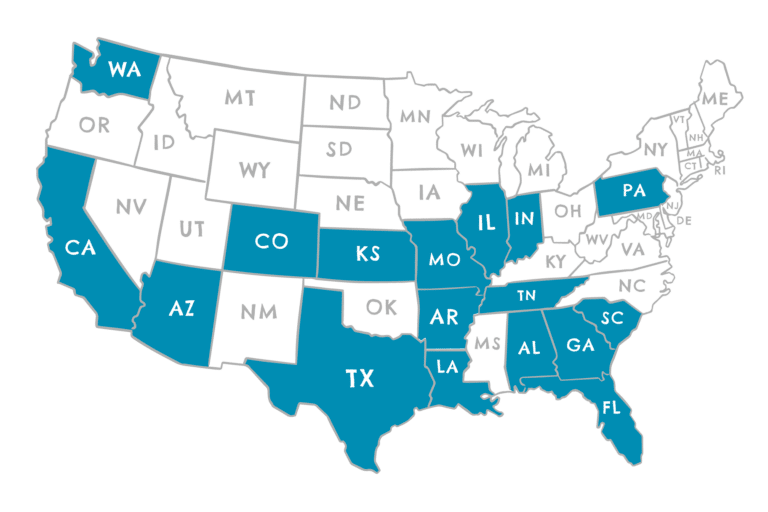

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington