HELPING INDIVIDUALS AND EMPLOYERS PIECE TOGETHER THE HEALTHCARE PUZZLE

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque velit nisi, pretium ut lacinia in, elementum id enim. Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus. Pellentesque in ipsum id orci porta dapibus. Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem. Curabitur arcu erat, accumsan id imperdiet et, porttitor at sem.

INSURANCE CUSTOMIZED TO YOUR EXACT SITUATION

Schedule a Consultation

insurance products

Medicare

For those approaching or older than 65, we can guide them to the best coverage with reliable providers.

ACA/Obamacare

MBhealth is here to help you understand a variety of health insurances, including the Affordable Care Act, Individual/Family Insurance and Self-Employed Insurance.

Missouri Chamber Benefit Plan

This plan is specifically designed for Missouri businesses to help them provide benefits for employees while keeping costs low.

Dental and Vision Insurance

To help individuals and families minimize their dental and vision costs, we match them with the providers that best meet their needs.

Life Insurance

Protect those that depend on you with the right type and amount of life insurance.

Other Insurance Products

We also offer insurance to cover disability, long-term care, medical travel and more.

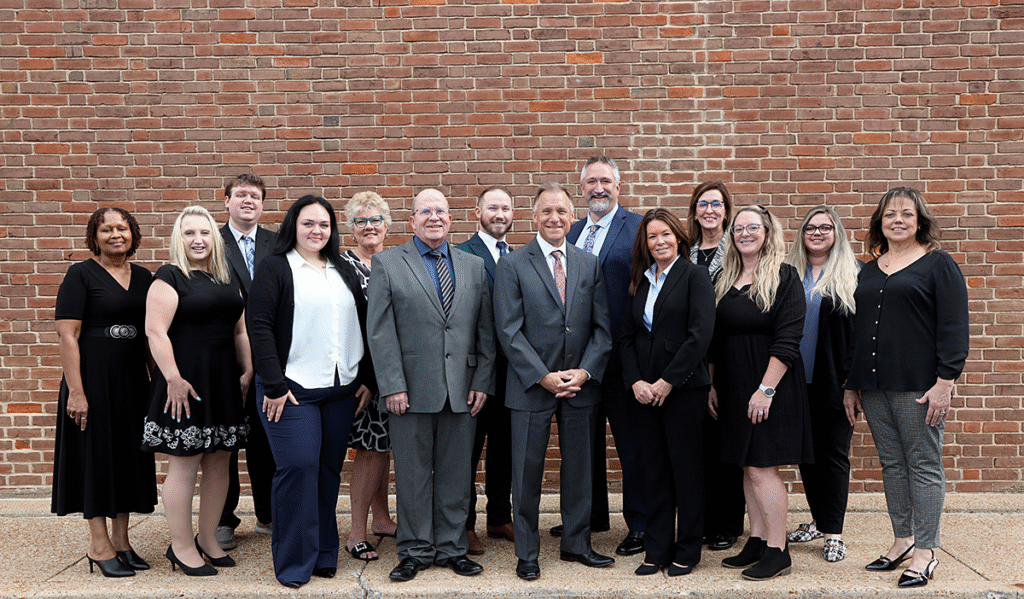

Our Purpose

At MBhealth, you’re our client, not the insurance companies. That’s why our only concern is your needs. We help individuals, families and small businesses in Missouri, Illinois and many other states find the best plans and then follow that with year-round interest in their well-being.

We’ll never recommend a policy or plan that is not suitable for your budget or situation.

What Our Clients Tell Us

We are extremely grateful for our clients’ continued business. Every year, our agents invest many hours in keeping up with changes in the insurance industry so we can continue to provide excellent service.

our knowledge center

Subscribe to Our Mailing List!

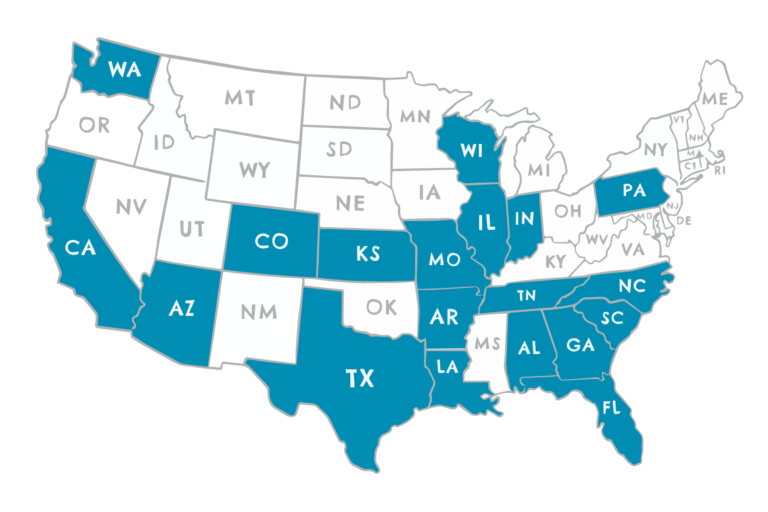

STATE LICENSURE

MBhealth is licensed in the following states:

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- North Carolina

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington

- Wisconsin