LONG-TERM DISABILITY INSURANCE

Helps Protect Your Financial Security

Long-term disability insurance provides an important safety net for individuals whose income would be curtailed if a disabling injury or illness occurred. Each year, about one million Americans become disabled for a long period, either due to illness or injury. Disability may result from heart disease, musculoskeletal problems, cancer, accidental injury or nervous system disorders. These problems very often show up without warning.

Most people ensure they are covered by health insurance but may not think about the long-term effects of disability. The lack of long-term insurance then places a significant burden on families and can seriously endanger their livelihoods and even their housing. When planning for your financial future, long-term disability insurance should be considered.

Who Should Consider Long-Term Disability Insurance?

Anyone who relies on their income to meet their daily expenses is advised to consider long-term disability insurance. This type of insurance is not just for those in high-risk professions. Anyone in a physically demanding job can suffer an injury that ends their ability to work. Those in high-income and stressful positions or who work in professions that might present risks to their health may be more susceptible to injury or disability. In fact, anyone who wants to protect their financial future can benefit from long-term disability insurance.

Professionals in the following fields may have greater needs for long-term disability insurance:

- Healthcare workers: Doctors, nurses, and other medical professionals rely on their best physical and mental capabilities to perform their jobs. They are also exposed to unique risks of illness or injuries in their work.

- Skilled tradespeople: Contractors, carpenters, electricians, welders and construction workers are very often in risky environments that could threaten their ability to continue employment. Injuries in this environment can be serious and the individual may be unable to return to their trade for months or even years.

- Self-employed individuals: Entrepreneurs and business owners typically lack the support of the type of benefits available to salaried employees. For these individuals, disability insurance is highly valuable because their income may stop entirely if they are unable to work.

- First Responders: Police officers, emergency medical technicians and firefighters are exposed to highly risky working environments. These professionals may suffer physical or emotional injuries that disable them.

- Office workers and professionals: Sedentary jobs are not performed in risky environments but can be subject to high-stress or repetitive stress injuries. When the injury becomes severe, salespeople, lawyers, accountants, and executives may be unable to work for a long term.

Disability insurance offers peace of mind that one’s finances will remain intact during a long recovery. Anyone with financial responsibilities—mortgage payments, families or other obligations—should consider long-term disability insurance.

When Do Long-Term Disability Payments Start Being Paid Out?

Long-term disability policies have waiting periods called elimination periods before payments start. From the time the injury or disability occurs, the insured person must first satisfy the policy’s elimination period that ranges from 30 to 365 days.

- 30 days: There is quicker access to benefits but the premiums are considerably higher.

- 60-90 days: This is the most common waiting period which balances affordability with reasonably fast access to funds.

- 180-365 days: If a person has substantial savings or other assets, they may be able to wait longer until benefits begin. Premiums will be proportionally lower.

When you are considering your financial future, it’s essential to frankly evaluate your current and future financial situations and estimate how long you can wait for benefits.

What Is Involved in Qualifying for Long-Term Disability Payments?

Once the elimination period is satisfied, the individual must also be declared disabled by a medical professional. Carefully inspect the policy’s definition of “disability.” Some plans exclude certain conditions as a basis for disability. For example, some policies only pay benefits if you are unable to perform the duties of any job, while others will pay if you are unable to perform the duties of your specific occupation. This can be a very important distinction if a disabling account or illness occurs.

What Do Long-Term Disability Payments Typically Cover?

Long-term disability payments are only designed to cover a portion of the insured person’s income. The range is typically from 50% to 80% of pre-disability earnings. These payments are meant to assist the individual in maintaining their standard of living while unable to work. Benefits can cover for a wide range of expenses, such as:

- Mortgage or rent payments

- Utility bills

- Groceries

- Other essential living costs

- Car payments and transportation

- Health insurance premiums

- Childcare and education expenses

Some policies offer services to help a person transition back to work. Also check a policy you are considering to see if it offers partial disability benefits if a person can only work part-time as long as they are disabled.

How Much Coverage Should You Obtain?

When deciding how much long-term disability coverage to request, there are many factors related to your income and expenses that you should take into consideration. If you are disabled, you will need enough income to maintain a desirable standard of living during your disability. Consider your current income, family situation and savings that can enable you to weather the period spent disabled.

At MBhealth, we use our experience to help our clients determine the proper amount of coverage for their circumstances. We help each client consider their overall financial situations, future plans and goals when deciding on long-term disability insurance.

What Our Clients Say

LONG-TERM DISABILITY INSURANCE Frequently Asked Questions

Once you have obtained long-term disability insurance, it’s important to know what must happen to qualify for these benefits.

First, you must experience a disability that lasts longer than a year verified by your physician and medical records. Disabilities that will prevent a person from working and earning an income for less than a year are insured through short-term disability insurance which is often offered through one’s employment. Long-term disability may be offered by an employer or be purchased by an individual.

Second, your disability must meet the definition of disability included in the policy. Please note that your policy may only cover you if an illness or injury prevents you from working in any occupation. Other disability insurance policies will cover you if you are unable to work in your own preferred occupation. This distinction is important for a person who has a high-earning specialty, such as a surgeon who can no longer perform surgery.

Once you have covered these points and find you are qualified, you need to file a claim. You will need to authorize your insurance company to review your medical records to verify your disability claim.

When you are looking for disability insurance, make sure you have the right guidance to get the best coverage for you. Contact MBhealth for expert advice.

Yes, you can file a disability claim while you are still employed. Typically, a disability claim is filed when a person can no longer work or can’t work effectively in the same job they held before the injury or illness.

Whether or not you can begin to receive disability benefits depends on the exact terms of your insurance. Most people get this kind of insurance, especially short-term insurance, through their employers. Long-term disability insurance may be offered by employers or be obtained by individuals.

You will need to provide complete medical documentation in order to support a claim on your disability insurance. Normally, this is done by assigning your insurance company the right to review your medical records.

Short-term disability insurance covers disabilities that are likely to affect a person for a year or less. Long-term disability insurance applies to disabilities that last longer than a year, typically from two years to the rest of a person’s life. It is essential to understand all the provisions of a policy when you are purchasing a short-term or long-term disability insurance policy. MBhealth can help you understand the provisions of policies available to you so you can get the right insurance for your situation.

When you need to file a claim on your long-term disability insurance, you should expect a delay —called a waiting period—of between 60 and 180 days before you start receiving benefits. In some types of long-term disability insurance, the waiting period can be as long as a full year.

This waiting period is also called the elimination period. The length of this period is stated in your specific policy. The shorter the waiting period, the higher the higher premiums.

Shorter waits are most commonly associated with short-term disability policies. Longer waiting periods result in cheaper premiums but of course you will have to cover your own expenses for a longer time.

You can choose the duration of your long-term disability benefits. You should assume that the longer you want to be able to receive benefits, the higher your premiums will be.

When purchasing short-term or long-term disability insurance, it’s essential to understand all the terms of your insurance to avoid surprises. When you are suffering from a disability, that’s the time you do not want to find out that your insurance does not help you when you need it most. For help obtaining disability insurance that protects both you and your family, contact MBhealth.

Short-term disability insurance typically provides benefits for six months to a year and is usually provided through a person’s employment.

The duration of long-term insurance can vary dramatically. Since this insurance is often purchased by an individual, they can choose a period as short as two years or as long as the rest of their life until retirement.

The waiting period until benefits start being received is generally briefer for short-term insurance, often between 30 and 90 days. With long-term insurance, the waiting period can be 90 days to a full year. It’s also possible to obtain disability insurance with a waiting period of zero days but it will have a higher premium..

Short-term disability insurance pays a higher percentage of the person’s usual wages—up to 80%. Long-term insurance pays slightly less but, of course, continues to pay for a much longer term.

Because much more is paid out from a long-term insurance policy, the premiums are significantly higher. This insurance is designed to help people who have been seriously injured or who have become severely ill and may never be able to work again. Short-term insurance is designed to help those suffering from a health condition they can recover from.

Whether you are planning to offer disability insurance to your employees or you’re seeking your own coverage, call MBhealth to get the exact coverage you need.

The correct answer to this question should ideally be calculated after a conversation with an experienced insurance consultant. That’s because there are so many costs that should be taken into account before the policy is purchased.

You need to consider factors like these:

- How much income are you accustomed to bringing in? You should plan to replace 60% to 80% of your pre-disability income after taxes.

- What other disability benefits do you have available? Would you qualify for Social Security Disability Insurance (SSDI) if you were injured or ill? Your long-term insurer may require you to apply for SSDI to receive their payments.

- How much does it cost you and your family to live? Are you the major breadwinner?

- How much debt do you have? You will need to continue to pay these bills.

- How long do you want your long-term benefits to last? Long-term benefits may last as little as two years or till age 65 or later. Just remember, the longer you receive benefits, the higher your premiums.

Whether you receive this insurance through your employment or on your own, the amount of long-term insurance you purchase should fit into your overall financial situation and goals. Talk to the experts at MBhealth to review your entire situation and get the right disability insurance.

We Can Help You Plan for All Eventualities

When you are making plans for your financial future, contact us to learn more about long-term disability insurance. We work for you, not the insurance companies and are only interested in protecting your assets and peace of mind. We routinely help those in Missouri, Illinois and other states obtain the insurance they need to protect themselves, their families and their possessions. Contact us by calling (314) 544-5400or use the contact form below.

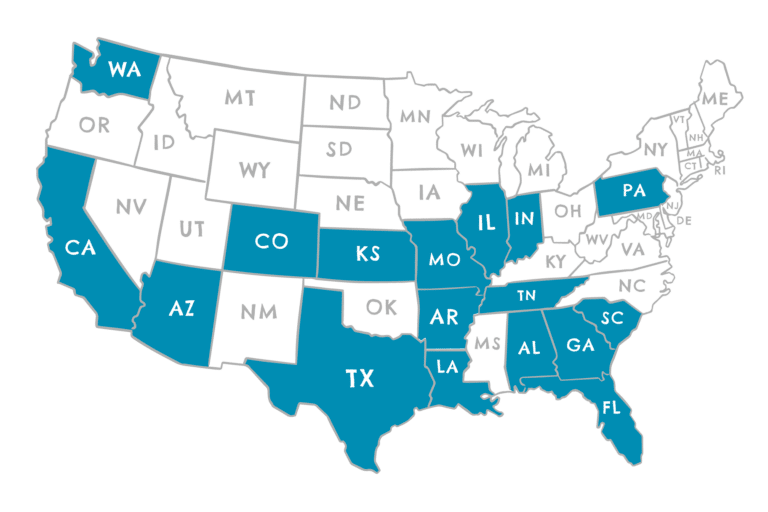

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington