ANCILLARY INSURANCE

Supplemental Coverage for Vision, Dental, Accident, and More

Ancillary insurance refers to additional coverage that goes beyond a basic health or life insurance policy. By definition, it supplements other types of insurance. It fills in gaps by offering benefits for services or expenses that standard medical insurance may not cover, such as dental, vision, or costs from accidents or critical illnesses. While these types of coverage might seem minor, when illnesses or injuries do occur, they can be the key to providing financial security for individuals and families.

Vision Insurance

This type of insurance is important for those who regularly need eye care or feel that they might in the future. This insurance typically covers eye exams, prescription lenses, contacts, and sometimes corrective surgeries like LASIK. If there is a history of vision problems or if the family has heritable vision problems, or if they are aging or they have jobs that endanger the eyes, this coverage becomes more important. Without vision coverage, out-of-pocket costs for glasses, exams, or surgery can add up, especially for families.

Dental Insurance

When well utilized, dental insurance can provide significant value, especially for families. Many dental procedures such as crowns, root canals and braces can be extremely expensive when there is no dental insurance. Ancillary dental insurance typically covers preventive care such as cleanings and exams and basic dental treatments like fillings. It also covers major services like bridges or dentures at a lower percentage of the cost. Dental insurance encourages regular preventative care which can help prevent the need for more costly procedures.

Accident Insurance

Accident insurance provides cash benefits to help cover costs that may not be covered by basic health insurance. Costs of emergency room visits, hospital stays, transportation, and rehabilitation that are not covered by health insurance can be covered, along with household expenses during recovery.

Final Expense Insurance

This ancillary insurance is also known as burial insurance. It helps families cover end-of-life expenses, including funerals, medical bills, and other debts. This type of insurance is usually obtained by older adults without significant savings or other life insurance to cover final costs. Most final expense policies are smaller, ranging between $10,000 and $25,000, to cover the cost of burial services and small debts.

Supplemental Medicare Insurance

Medicare provides coverage for both hospital and medical care needs, but it doesn’t cover everything. Supplemental Medicare insurance, also known as Medigap, helps to fill these gaps by covering additional costs such as copays, deductibles, and other out-of-pocket expenses.

Why Life Insurance Is Sometimes Considered Ancillary Insurance

When individuals make plans for their financial futures, life insurance is often part of the overall plan. In coordination with an experienced insurance consultant, many people add life insurance as they develop plans for health insurance or final expense insurance. There are multiple types of life insurance, including term life, whole life, and universal life. For more information on the life insurance services we help our clients with, view the information available here.

Young families, individuals with large debts like a mortgage, and business owners often need life insurance the most. It ensures that if something happens to the policyholder, their loved ones are financially secure.

How Much and What Types of Ancillary Coverage Do You Need?

This question is best answered in a conversation with an experienced insurance consultant who works for you, not the insurance companies. At MBhealth, we are interested in the financial plans and goals of our clients and help them sort through all the factors they should take into account as they make decisions.

Young families usually prioritize life insurance to provide for family members left behind, dental insurance for growing children, and accident insurance for active kids.

Seniors often are most concerned with final expense insurance, vision, and dental coverage, along with Medicare supplemental plans.

Individuals with high-risk jobs or active lifestyles may need accident coverage in addition to their basic health insurance.

We can help you assess your current medical and financial needs and anticipate future risks. Adding ancillary insurance to your portfolio can provide extra protection and peace of mind, ensuring you are covered in a variety of life situations.

What Our Clients Say

ANCILLARY INSURANCE Frequently Asked Questions

Ancillary insurance is coverage that supplements your major insurance policies. Whether or not you obtain ancillary insurance coverage depends on how much you want to avoid gaps in your Medicare coverage.

There are several types of ancillary insurance that can broaden the coverage you receive with Medicare.

- Coverage for gaps in Medicare Parts A and B coverage: Ancillary insurance can cover copays, deductibles and coinsurance.

- Medical travel insurance: If you travel out of the country, Medicare may limit or not cover your costs. Medical travel insurance can cover doctor, hospital, surgical and pharmacy costs.

- Prescription drug coverage: Adding Medicare Part D prescription drug plan can keep your medication costs lower.

- Dental and vision insurance: Adding this insurance can help you care for your whole family at a more affordable cost.

- Cancer: This type of policy can pay out as a lump sum or cover costs for treatment as they occur. There may be no network restrictions associated with a cancer or other type of specified disease insurance policy.

The decision about ancillary insurance is best made in coordination with an insurance consultant that works for you, not an insurance company. That person can take your entire financial situation into account and help you plan your future. Talk to the experts at MBhealth now.

There are more than a dozen types of ancillary insurance covering a wide range of risks. Many are offered by employers and others are more typically selected by individuals. Here are just some of the types of insurance you might choose to protect your financial future:

- Short-term disability for an inability to work of a year or less

- Long-term disability for disabilities lasting longer than a year and possibly the rest of a person’s life

- Vision insurance to cover exams, eyewear, contact lenses and procedures

- Dental insurance for both preventative and major dental care

- Life insurance to provide support for a family after one’s death

- Accident insurance to supplement medical coverage and cover non-medical costs

- Hearing insurance to pay for diagnosis and treatment plus hearing aids

- Critical illness insurance to cover emergencies like heart attacks, stroke, cancer or other illnesses

- Pet insurance to pay for veterinary treatment of a pet or to provide benefits if the pet dies

- Long-term care insurance to help those with chronic conditions pay for costs not covered by health insurance, due to being in a nursing home for example.

Of course, every type of ancillary insurance comes with a cost. The right kinds of ancillary insurance to obtain depend on a person’s financial goals. Make the right decisions with the help of experts at MBhealth.

Yes, vision insurance is one of many choices for ancillary insurance. If a person’s health insurance does not already include vision care, vision insurance can fill this gap.

This type of insurance typically covers an annual eye examination and an allowance for prescription eyeglasses or contact lenses. Other services may be available at a reduced cost.

There are many types of eye care that are normally covered by health insurance. In the event of an injury, vision loss, dry eyes, eye diseases or infections or treatment for the effects of diabetes, a person’s health insurance would provide coverage for these costs. Medication is not covered by an ancillary vision insurance but may be covered by health insurance.

Major eye problems such as glaucoma or macular degeneration would also be treated as medical problems.

Individuals with Medicare would need to select an ancillary policy to obtain vision insurance. However, many Medicare Advantage plans include basic vision care in their benefits.

If you need help selecting vision insurance to complete your health coverage, contact the experts at MBhealth today.

Dental insurance is an ancillary insurance chosen by many people because of the high cost of many dental procedures. This becomes even more important when a family is being covered by dental insurance.

Most types of dental insurance offer very good preventative care benefits as these save the insurance company and the customers money. These preventative treatments include:

- Cleanings and examinations: These are normally scheduled at two appointments a year for all those covered by the insurance

- X-rays: A limited number of x-rays are included each year

- Fluoride treatments: These are covered to strengthen teeth against decay

- Sealants: Coverage mostly applies to providing these sealants for children, although some adults may qualify

- Space maintainers: When a child loses a tooth prematurely, space maintainers can help prevent future alignment problems requiring braces

There is normally a waiting period for receiving other services such as fillings, crowns, dental implants or bridges. The more expensive the service, the longer the waiting period is likely to be.

The right dental plan can help keep the whole family’s teeth in better condition while saving the family money. To find your best dental plan, contact MBhealth.

The amount of ancillary insurance you should have depends on your budget, your financial goals and your possible needs for insurance coverage. Your wisest choices will be made after a conference with an experienced insurance consultant that works for you, not the insurance companies. This consultant will help you review your complete financial situation and fit your ancillary insurance coverage into the bigger picture.

After your initial decisions about ancillary insurance, your needs may change when you get married, have a baby, or change jobs or careers. Be sure to review your insurance coverage from time to time.

Basic insurance plans such as those provided under the Affordable Care Act or Medicare may lack types of coverage that are important to you. These basic plans lack these specialized and targeted types of insurance coverage to keep them affordable. Your employer may offer you several types of ancillary insurance to choose from or you can purchase them directly from an insurance company or with the assistance of an insurance consultant.

You can choose from these and several other types of ancillary insurance:

- Vision

- Dental

- Hearing

- Long-term care

- Disability

- Cancer

- Life

- Travel

- Medical travel

For expert help choosing the right types of ancillary insurance to help you meet your goals, contact MBhealth.

MBhealth Can Make it Much Easier to Make the Right Decisions about Ancillary Insurance

Whether you want insurance to cover routine dental visits, vision care, or unexpected accidents, we can help you make the choices that ease your financial burden and eliminate catastrophic effects on your lifestyle. Contact us for assistance in selecting the right types of ancillary coverage to protect yourself and your loved ones from life’s unexpected costs.

Fill in the contact form below to schedule a free consultation for St. Louis Medicare supplemental insurance or any type of ancillary insurance for Missouri or Illinois residents. Or call us at (314) 544-5400 for immediate service.

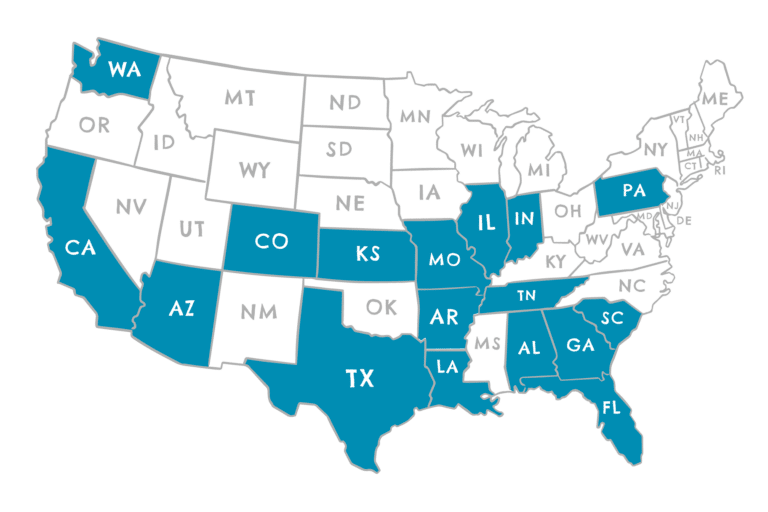

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington