MEDICAL TRAVEL INSURANCE

Who Should Have It and Why

Medical travel insurance offers peace of mind when you’re traveling abroad, especially when you go to destinations where your regular health insurance may not provide coverage. Whether you’re heading out for a brief vacation or you’ll be on an extended journey, unexpected health problems can arise. When you are prepared before leaving home, you can more easily get the help you need while you’re far away.

Medical travel insurance covers many different services you may need. These include medical care, hospitalizations, and emergency evacuations. Medical travel insurance protects you from the high costs of medical care abroad, ensuring you can focus on enjoying your trip.

This type of insurance can be purchased for individual trips or for the entire year if you will spend an extended time traveling. For the frequent traveler, choosing an annual policy can be the most convenient and cost-effective option. Many shorter-term policies may be able to be adjusted if your travel plans change, allowing for an extension of coverage.

The Key Benefits of Medical Travel Insurance

When traveling internationally, your regular health insurance may not provide coverage while you are outside your home country. Medical travel insurance ensures you are protected no matter where you are. Here are the benefits our clients value the most highly:

Emergency Medical Care

Should you suddenly become ill or have an accident, medical travel insurance ensures you have access to medical care ranging from doctor visits to hospitalization. This is especially important in the many countries where healthcare is expensive for non-residents.

Hospitalization

Medical travel insurance covers the cost of a hospital stay, surgeries or essential medical treatments, protecting you from crippling medical bills. Many countries have private healthcare systems—without insurance, you could be responsible for paying before you start to receive care or struggle with huge medical bills afterward.

Emergency Evacuation

There may be times that you need to be evacuated to a medical facility on an emergency basis or even returned immediately to your home to protect your health and life. This transport can be incredibly costly, especially if you have traveled to a remote area. If there is any possibility that you may need emergency evacuation, ensure that the medical travel insurance you choose provides for this service.

Repatriation of Remains

No one wants to think about this grim possibility but it happens. Medical travel insurance covers the cost of returning remains to their home. Cardiovascular disease, accidental injuries and drownings are the primary causes of more than 600 American deaths each year. Make sure you can be returned home if something happens to you (or someone in your party). If there is no medical travel insurance, the burden on families can be great.

Peace of Mind for Chronic Conditions

If you have a pre-existing medical condition, some travel insurance policies offer coverage for treatment related to these conditions. This is particularly important if you’re traveling for an extended period or to areas where medical care may be harder to access. It is vital to ensure that your medical travel insurance extends to coverage for any pre-existing condition that exists.

When Is Medical Travel Insurance Most Important?

While medical travel insurance is valuable for any international trip, there are specific times and places where it is essential.

- Travel to Countries with High Healthcare Costs: In countries like Australia, Denmark, Sweden, Norway, Switzerland and Qatar, medical expenses are extremely high for travelers from other countries. In Monaco, for example, a hospital bed could run you $2,400 per day. A simple emergency room visit could cost thousands of dollars. Hospital stays can reach tens of thousands of dollars.

- Remote Destinations or Adventure Travel: When you travel to remote areas or take part in high-risk activities like remote hiking, skiing or scuba diving, medical travel insurance becomes even more essential. Remote destinations will naturally have limited access to medical care. The possibility of emergency evacuation becomes more likely and could involve helicopters, boats or planes.

- Long-Term or Frequent Travelers: When a person travels for an extended time, there are more chances for medical emergencies. For the person on a gap year, sabbatical, or extended stay abroad, it is very wise to obtain medical travel insurance before leaving home. For the frequent traveler, especially those going to several countries in quick succession, annual travel insurance can be cheaper and cover any changes in your plans that come up while traveling.

- Countries with Required Travel Insurance: There are many countries that require proof of medical travel insurance before a traveler is allowed to enter. These countries include Cuba, Russia, Qatar, Ecuador, Nepal and most of Europe. To prevent your trip from being derailed, obtain medical travel insurance while making your plans.

How Much Insurance Should You Acquire?

Calculating the amount of medical travel insurance you need depends on your destination, the length of your trip, and the types of activities you plan to engage in. In European countries, you must have at least 30,000 Euros in coverage. Russia does not have a specific requirement but insurance of $50,000 is recommended. Many travel services recommend coverage of $100,000 for medical expenses and $300,000 or more to cover the possibility of emergency evacuation. At MBhealth we can help you determine the right amount of medical travel insurance to provide peace of mind for you or your family.

What Our Clients Say

MEDICAL TRAVEL INSURANCE Frequently Asked Questions

Medical travel insurance is an excellent way to protect yourself if you become injured or ill while traveling out of the United States. Your private medical insurance may only cover emergency medical care while you’re out of the country. Some health insurance companies don’t even provide this. Talk to your provider to determine your exact coverage while you’re traveling internationally.

Medicare covers almost no medical expenses outside the U.S. so an individual with Medicare should plan on having the funds to cover all of their doctor, hospital, medication and other health-related expenses while traveling. Medigap plans may provide out-of-country coverage but you’ll need to check the terms of your Medigap plans.

Because of all these variables, savvy international travelers often purchase medical travel insurance for their trip. What type of care is typically covered by this insurance?

- Ambulance service

- Hospital costs

- Surgical costs

- Doctor bills

- X-rays

- Medicines

- Lab tests

Some prescription medication coverage include medical evacuation insurance to pay for evacuation to an adequate medical facility to treat their illness or injury. This can also cover the cost to bring a person home on a commercial flight, including a medical escort if it’s needed.

Getting the right medical travel insurance can be complicated. For guidance, contact MBhealth to get the exact coverage you need.

Travel insurance protects a traveler from financial losses that result from trip cancellations, lost baggage and trips ruined by catastrophic weather or natural disasters. It also covers costs resulting from missed airline connections and luggage delays. Many travel insurance plans also cover emergency medical care provided while in the travel destination. In this case, travel insurance supplements a person’s usual medical insurance to help cover the cost of sudden illness or injury while traveling.

Medical travel insurance will cover the cost of emergency medical care plus the cost of doctor or hospital visits, x-rays, medicines and more. It may also cover medical evacuation to a medical facility qualified to treat your illness or injury.

The more comprehensive your travel insurance or medical travel insurance, the more these policies prevent financial losses while you are traveling. It’s vital to get very familiar with all the provisions of your travel insurance or medical travel insurance to make sure you have the coverage you want. Having the right insurance as you travel out of the country is a good way to maintain peace of mind so you can just enjoy your trip.

Getting the right medical travel insurance can be a little complicated. For help obtaining the exact travel coverage you want, contact MBhealth today.

An insurance company offering medical travel insurance ideally wants to provide coverage for people who are currently healthy and do not engage in activities that are likely to cause them to file claims for medical care while traveling out of their home country.

Therefore, most insurers will not cover costs resulting from:

- Pre-existing health conditions

- Preventative or routine medical care

- Elective medical treatments

- Childbirth

- Dental or vision care other than emergency treatment

- Cancer treatment

- Injuries resulting from extreme sports

- Accidents or injuries resulting from alcohol intoxication or drug use

- Emergency evacuations unless this is specifically included in your plan

- Transport to your home country after an injury or illness unless specifically included in your plan

If you experience an “acute onset of a pre-existing condition,” many insurers will deny coverage. In other words, an illness or health condition that previously occurred but was not chronic suddenly shows up again. If you think you need this type of coverage, you will need to carefully check a plan’s details to make sure you have the coverage you want. To get help obtaining the exact medical travel insurance you want, contact MBhealth today.

An insurer providing medical travel insurance may refuse to provide coverage for certain pre-existing health conditions. You may be able to get coverage for other health conditions or injuries but not for a problem that existed before your trip.

There are quite a few restrictions related to what a pre-existing condition is. The definition of pre-existing condition and the restrictions related to it vary from one insurer to another. One insurer states that it is:

- An injury, illness or medical condition that a reasonable person would have sought treatment for that was experienced in the 60 days before insurance takes effect

- An injury, illness or medical condition that you suffered symptoms of, got treatment for or needed to take medication for in the 60 days before you purchased your plan

- The exception is when the symptoms of that condition were controlled by the prescription and the prescription has not changed.

Medical travel insurance may provide coverage for the sudden onset of a pre-existing condition if that falls outside the limits described above or is specifically covered by your plan.

Obtaining medical travel insurance when you have a pre-existing condition is tricky. It’s vital to understand all the conditions and waivers of a plan you are considering. To ensure you have the coverage you want, contact MBhealth and let them help you choose the best medical travel insurance for your situation.

The ideal amount of medical travel insurance you need before a trip depends on the kind of trip you are taking and where you are going. If you are traveling internationally where your usual medical insurance may not be helpful, you would be wise to obtain at least $50,000 in emergency medical coverage.

If you are taking a cruise or traveling to a particularly remote destination, a higher level of medical travel insurance is advised. Look for a policy providing $100,000 in medical travel insurance. Medical evacuation insurance is also available that covers the cost of transporting you to the nearest adequate medical facility, including transporting you home if needed.

Medical travel insurance typically covers charges for ambulances, doctors, hospitals and surgery, x-rays, lab tests and medications. There is usually some limited coverage for emergency dental care that may be needed. The duration of the insurance is normally set just for the time you will be on a trip.

Medical travel insurance is a smart addition to your travel plans that could also include travel insurance to protect you from loss because of trip cancellation, trip interruption or lost baggage. If you have international travel in your future plans, consult with MBhealth to obtain any types of insurance needed to provide peace of mind.

The Best Way to Get the Insurance You Need Before Your Trip

For medical travel insurance in Missouri, Illinois or another state, call MBhealth while you’re making your plans. We work for you, not the insurance companies, and we are dedicated to helping our clients get the insurance they need for their safety. Contact us at (314) 544-5400 or use the contact form below and we will be in touch within two business days.

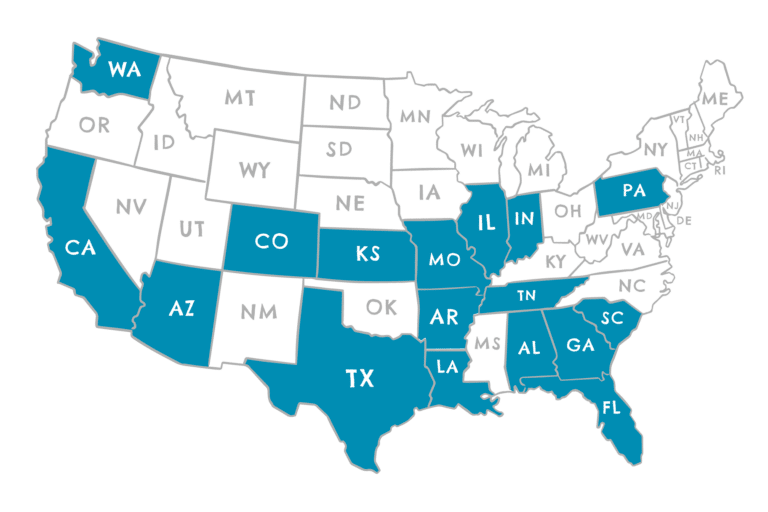

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington