ABOUT US

At MBhealth, we have a unique approach to providing insurance services. Yes, we are a Missouri insurance agency, but we represent our clients throughout the nation, not the insurance companies!

We know how to untangle complicated situations involving blended families, intricate investments and assets to get our clients the best prices. Every day, we simplify this subject for individuals, families and business owners so that everyone can get the insurance coverage they need—without the headaches!

MEET THE TEAM

Mike Butz

CEO & Founder of MBhealth

Mike Butz has devoted his faith-filled career to guiding individuals, families and small businesses through the health insurance decision-making process. Mike knows that choosing healthcare coverage can be both stressful and confusing, and he works hard to ensure that the experience is a positive one.

Mike is a certified advisor for Medicare and the Healthcare Marketplace (also called Obamacare or Affordable Care Act). He is also a member of the Life Insurance Underwriting Training Counsel (LUTCF) and can offer a variety of strategies for life, disability, and long-term care insurance needs.

Mike and his wife Kim have five children and five grandchildren. They live in Fenton, Missouri. They regularly attend and are active in the First Baptist Church of Fenton.

Daniel Jung

ACA & Small Group Agent

Daniel Jung has worked in health insurance for more than 20 years. He spent the first half of his career at Anthem Blue Cross Blue Shield where his experience ranged from customer service and sales to management. This background prepared him well for his current position with MBhealth as a Healthcare Advisor for Individuals and Business Owners.

He knows that choosing health insurance is difficult for many individuals, families and business owners. Having someone trustworthy and experienced to provide counsel throughout the insurance decision-making process is very important. Dan loves helping MBhealth clients because in this company, the individuals, families and businesses he serves are the primary focus.

Dan has been married to Pamela for 18 years. They live in Columbia, Illinois, with their two sons Austin and Braden. Dan doesn’t want to forget to mention his Australian shepherd Macy.

With a daily goal of serving Faith, Family, and Business, Dan is here to help residents of Missouri and Illinois with any health insurance needs.

Robert Seay

Medicare & ACA Agent

Robert Seay has been in the health insurance industry since 1988. His experience has ranged from auditing and investigating claims to making sure they were paid. In 2005, he took his experience in the insurance field to the next level and joined Mike Butz as an Independent Agent.

His primary focus is helping Medicare-eligible individuals find the right plan. He also assists individuals, families, the self-employed, and small business owners navigate the complex world of health insurance.

Robert has been married to Tricia for more than 25 years. They have two children and two grandchildren. He is also very active in the First Baptist Church of Fenton.

Bobby Dean

ACA Agent

Bobby joined MBhealth in April of 2023 and is very excited for his future here! He has a Bachelor of Science in Information Systems. Bobby wanted a career where he could serve people and that’s what brought him to insurance sales.

He is starting out in the ACA/ Obamacare side of insurance and is looking forward to expanding into other types of insurance. He cannot wait to meet our clients and serve our community!

Bobby’s activities and interests cast a wide net. He is an avid outdoorsman, and enjoy hunting, fishing, and camping. He is also a drummer and takes great pride in serving at Oak Bridge Community Church in South City. Bobby is expecting his first baby with his wife Tara, and they are thrilled to become parents!

Gretchen Hendricks

Large Group Agent

With over 24 years of experience in the healthcare industry, Gretchen Hendricks specializes in helping employers optimize their healthcare strategies, with a focus on group insurance and personalized solutions. She attributes much of her expertise to her 24 year-year tenure at Anthem Blue Cross and Blue Shield, where she gained invaluable insights into healthcare solutions and employee-focused care.

Now, at MBhealth, a family-oriented company, she is dedicated to working closely with key partners to ensure their unique healthcare and insurance needs are met. Gretchen’s passion lies in making healthcare accessible and effective, providing tailored plans that support both company wellness and individual well-being.

Gretchen lives in Edwardsville, IL, where she enjoys spending her time outside of work. Traveling is one of her favorite hobbies, as it allows her to explore new places and experiences. Gretchen also values spending quality time with family and friends, as it helps her stay connected and grounded.

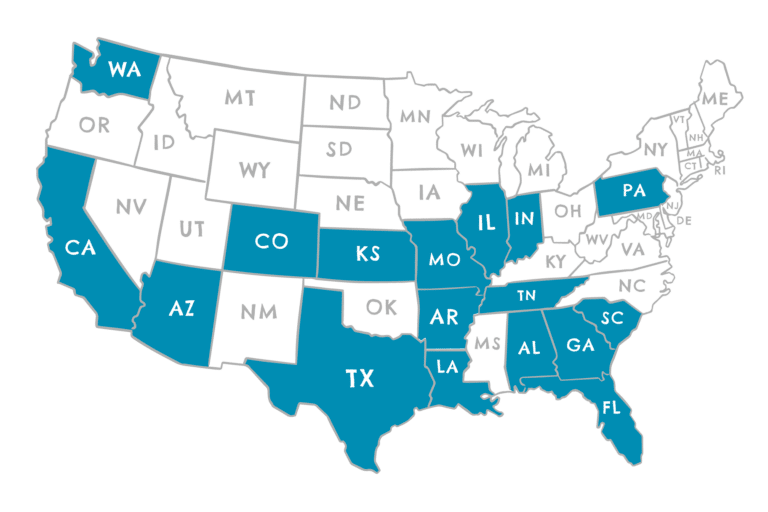

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington

MBHEALTH IN THE COMMUNITY

We believe that operating an ethical and community-conscious business should involve supporting those activities and organizations that actively work toward a better world for all. For that reason, we have always participated in community events from taking part in parades to sponsoring sports teams and supporting our local Chamber of Commerce.