LONG-TERM CARE INSURANCE

Protecting Your Future

As we age, the need for long-term care becomes a more important consideration. Long-term care costs can be substantial and can eat into one’s wealth, diminishing funds one has other plans for. Long-term care insurance helps cover costs associated with nursing homes, rehabilitation services, and assistance with the activities of daily living such as bathing, dressing and eating. Whatever reason there is for this care, this insurance helps protect your assets and enables you to receive quality care without burdening your family’s finances.

Who Should Have Long-Term Care Insurance?

While long-term care insurance (LTCI) isn’t for everyone, it can be an important financial tool for those who are planning for their retirements and who want to protect assets. The best time to obtain long-term care insurance is in your 50s or early 60s. Premiums are more affordable at this age and there are fewer complications when qualifying for this coverage. When health problems arise, premiums can increase prohibitively, or you could be denied coverage.

If you have a high net worth, you can protect these assets by obtaining this insurance. Otherwise, the long-term care needed after a health crisis can deplete these assets you would rather benefit your family. A person with $500,000 to $2 million in assets is wise to consider obtaining this coverage early. If your assets are even higher, you may have sufficient wealth to cover all long-term costs without difficulty. The decision is yours.

Those with few assets may qualify for Medicaid, which can help cover nursing home costs. However, for those with mid-level assets, long-term care insurance provides for care without draining savings or jeopardizing one’s financial goals.

How Net Worth and Financial Goals Influence the Decision

The decision to purchase long-term care insurance involves looking at an individual’s financial picture and goals. Long-term care insurance can be pricey, and the cost may increase as a person ages or suffers health issues. At MBhealth, we work with each client to review their entire financial situation to help them make a decision. Our job is not to sell insurance but to help our clients acquire the insurance that gives them peace of mind.

If leaving an inheritance is a key part of your financial goals, we can help ensure that long-term care expenses don’t erode the value of your estate.

Types of Care Covered by Long-Term Care Insurance

Long-term care insurance can cover a variety of healthcare services that might be provided in a home or in a community setting or a nursing facility. Common types of care that are covered include:

- In-Home Care: Assistance with activities of daily living (ADLs) such as dressing, eating, bathing, and mobility. It may also cover skilled nursing care provided in your home.

- Assisted Living Facilities: These facilities offer housing, meals, and personal care assistance for individuals who cannot live independently but do not require full-time medical assistance.

- Nursing Homes: Nursing home care includes around-the-clock supervision and medical assistance.

- Rehabilitation Services: After an injury or illness, rehabilitation services like physical therapy, occupational therapy and speech therapy may be covered.

- Adult Day Care: Some policies cover adult day care services, which provide supervision, social activities and medical assistance during the day.

- Memory Care: For those suffering from Alzheimer’s or other forms of dementia, specialized memory care services are typically covered.

It’s important to carefully review all the provisions of a long-term care insurance policy to understand exactly what services are covered so there are no surprises. This is another area where MBhealth is helpful to our clients. We learn what is important and ensure that they get the coverage they really want.

How and When Long-Term Care Benefits Are Paid Out

In general, long-term care benefits begin to be paid out when you are unable to perform a certain number of “activities of daily living” (ADLs). These include essential activities like dressing, bathing, eating, and moving around. Most policies specify that you are unable to perform two or more ADLs before benefits are triggered. In addition, cognitive impairments such as Alzheimer’s disease often qualify for coverage.

Once the conditions are met, the policyholder begins receiving benefits after the elimantionperiod. Payments can either be made directly to the care provider or reimbursed to the policyholder once the care has been paid for. Some policies specify daily or monthly benefit limits.

Who Receives These Long-Term Care Payments?

Long-term care insurance payments can be made directly to the care provider, such as a nursing home or in-home care service. However, most policies allow the policyholder to receive the benefits directly, the insured person has greater flexibility in how the funds are used. In such cases, the individual can decide if they want to hire a personal caregiver or pay a family member for assistance. It’s important to realize that not all policies cover informal caregivers such as relatives.

Pay Attention to Waiting Periods and Elimination Periods

Most long-term care insurance policies have a waiting or elimination period before benefits are paid out. This is the period of time during which you must pay for your own care before your insurance payments kick in. Elimination periods usually range from 30 to 90 days, although some policies may have longer periods. Choosing a longer elimination period may reduce your premiums, but it also means you’ll need to be prepared to cover those initial costs for a longer time.

What Our Clients Say

LONG-TERM CARE INSURANCE Frequently Asked Questions

There are many options available for long-term care. First, you can obtain traditional long-term care insurance that covers the cost of many different types of care:

- At-home care where you can get skilled nursing care, rehabilitative therapy or help with personal care

- Residence in memory care facilities

- Hospice care

- Adult day service center care

- Residential living facilities

- Convalescent homes

Second, you can get a hybrid policy that combines traditional life insurance with long-term care insurance. This kind of policy gives you access to the death benefit funds provided by the life insurance policy to help you pay for long-term care.

The third choice is to add a rider to your life insurance policy that allows you to use part or all of your death benefit for your long-term care.

There are many variables to be considered when choosing these policies from the insurance companies that offer them. One of those variables is the maximum age at which the policy can be issued. Another is the length of time the costs of care will be covered. It’s important to compare all the variables of any long-term care policy you are considering. For help obtaining your best long-term care coverage, contact MBhealth.

Any of the insurance companies offering long-term care insurance require certain benefit “triggers” to be experienced before they start paying for care. For example:

- The individual is unable to manage at least two of six Activities of Daily Living (ADL) without help, such as being able to move from a chair into bed or keeping themselves clean

- They have a cognitive impairment

- A doctor recommends they begin to receive long-term care

In the case of the ADLs, the person must have lacked the ability to manage these ADLs for at least 90 days. If cognitive impairment exists, the person must require significant supervision.

Pre-existing conditions that caused these disabilities are not covered by long-term care insurance. There may also be a maximum limit on the years or amount of benefits to be paid.

Before benefits begin to be paid, there is often a waiting period which some companies call an elimination period. This typically lasts from 20 to 100 days before the policy will pay for long-term care costs.

Once a long-term care policy is obtained, the premiums and benefits may change each year to keep up with inflation. Are you looking for long-term care insurance? Talk to MBhealth to get the best care insurance for your situation.

Long-term care insurance policies often pay for care that is received at home, for example, for payment of home health care or personal care assistance. In other cases, a person may need to take up residence in a memory care or rehabilitation facility. The benefits can be paid to the family in the event of home care or the facility in the event of residential care.

Many companies that previously offered long-term care insurance have stopped doing so. There are currently six companies offering this type of insurance. If you are considering long-term care insurance and you can afford it, your prices will be lower if you obtain this insurance while you are in your 50s or 60s.

Over time, your premiums will increase if your policy has a provision for inflation growth. At the time you will need long-term care, care costs will undoubtedly be higher than they are today. To ensure that you receive the kind of care you want when you are no longer able to care for yourself, your benefits need to gradually increase along with the rate of inflation.

When you are shopping for long-term care insurance, contact MBhealth to find the perfect policy to put your mind at rest.

Benefits of long-term care insurance cover the many expenses of care provided to an older person who can no longer fully take care of themselves. The criteria for beginning to receive these benefits may include:

- Being unable to perform at least two out of six Activities of Daily Living such as feeding oneself, bathing, dressing or moving from chair to bed

- Experiencing cognitive impairment

- Receiving a recommendation from a medical doctor

When a person is qualified for long-term care, this insurance policy begins to pay for the costs for the person’s care. The exact benefits provided vary somewhat by state, but typically include:

- Nursing home care

- Residence in a care facility that provides assisted living

- Home health care

- Adult day care

- Homemaker services

- Hospice

- Respite care

Some long-term care insurance policies require a waiting period of 20 to 100 days, but others do not have any waiting period.

Many residential facilities offer personal care, recreational activities, meal service, and medical services. Aging individuals obtain long-term care insurance to ensure their comfort, protect their wealth and ensure there is an inheritance for the next generation. When you are comparing long-term care policies, contact MBhealth for guidance to the best type of policy for your situation.

The amount of long-term care you should have is a very personal decision that is best made with advice from an experienced insurance consultant. Of course, the amount of long-term care insurance you can afford is also a determinant of how much insurance you should have.

You will need to take the following factors into account when you make your choice:

- Your current age

- Your current health condition

- How long you want the care benefits to last

- Whether or not you want your benefits to keep up with increases due to inflation

Your net worth and savings also have relevance, as the more savings you have, the less insurance you may need or choose to self insure for a longer period.

You also may want to fold your long-term care insurance into your life insurance policy, creating a hybrid that enables you to utilize death benefits for your long-term care.

If you make no plans for long-term care insurance, you will probably be limited to Medicaid which provides limited choice for those who need skilled nursing care. If you are currently in the market for long-term care insurance, please call MBhealth for guidance as you decide on the best arrangements for your future.

Contact MBhealth to Secure Long-Term Care Insurance to Protect Your Future

Long-term care insurance is a valuable financial tool for those planning for the future. By securing coverage while you are still healthy, you can protect your savings, ensure access to quality care, and alleviate the potential financial burden on your family.

If you’re planning ahead for your retirement years, then it’s time to consider this insurance. To make this task simpler and stress-free, contact MBhealth. Call (314) 816-1696 to schedule a consultation or fill in the contact form below.

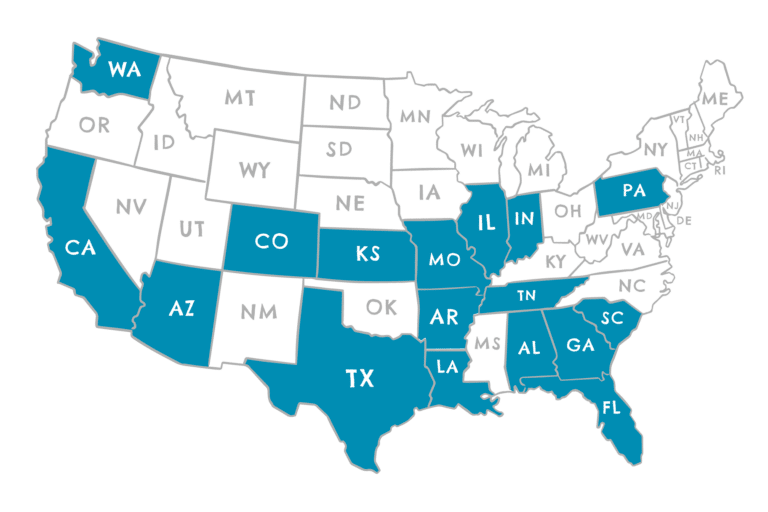

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington