INSURANCE PRODUCTS

OUR PROCESS

We have a unique approach: We represent our clients, not insurance companies. Therefore, we start by listening to our clients and learning about their needs and priorities. Then using our extensive experience and knowledge, we advise our clients on the best solutions for their needs.

We provide consultations and enrollments for all the types of insurance listed below.

Medicare

ACA/Obamacare

We work with all the following types of health insurance plans:

- ACA Plans: The Affordable Care Act (formerly Obamacare) of 2010 implemented health insurance reforms to make health insurance affordable for more people.

- Individual Health: We help individuals select the best coverage for their situation, whether through the ACA or direct to providers.

- Family Health: We guide families through the confusing maze of family insurance choices to get the best deal with the providers they want.

- Self-Employed: We assist self-employed individuals with no employees to minimize costs and maximize coverage.

Small Business Insurance

Small business insurance is designed for businesses with 2-50 employees. With our experience, we’ll help you get the right coverage at the best price.

Large Group Health Insurance

Large group insurance is a health insurance plan designed for companies with 51 or more employees (thresholds may vary by state). Get the best group insurance for your team.

Missouri Chamber Benefit Plan

Dental and Vision

Life Insurance

Other Products

Book a Free Consultation

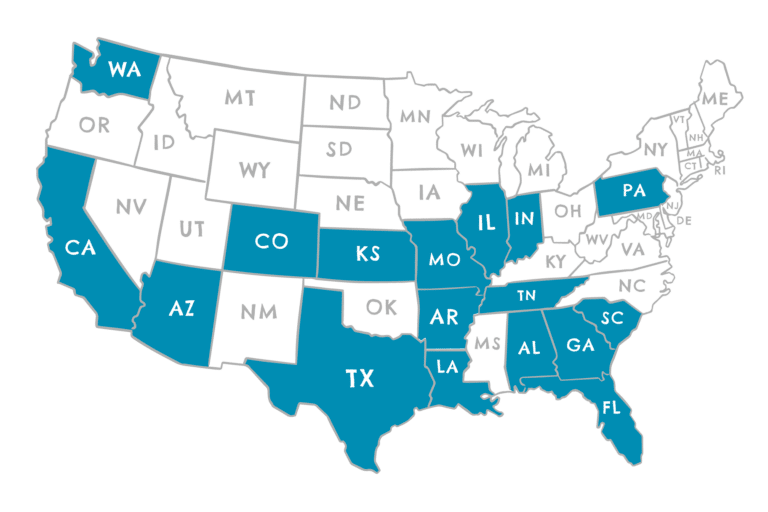

STATE LICENSURE

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Kansas

- Louisiana

- Missouri

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington